Tendering is a key part of the ocean freight procurement process. At Xeneta, through our customers, we are in contact with some of the world's largest industry stakeholders. We often hear that many people from multiple departments should be closely involved in a tendering process and on average, it is estimated 2 to 4 full-time full-time employees (FTE) are needed to ensure a project is completed.

There are also questions such as how much information is enough while freight tendering? Or how many rounds until we finalize negotiations? What kind of price breakdown should I be asking for? Find answers to all these questions and more in this webinar.

Using their expertise from processing over 55+MN spot & contracted long-term rates, Michael Braun, (Value Engineering Director) and Christian Schmans, (Director, Rate Management) discuss the standard tendering process and best practices you can implement to optimize your freight tendering process.

Presentation Transcript: Read below or download the full transcript in PDF format

Freight Tender Presentation Transcript:

Michael Braun: Hello, everybody, welcome to our next session of "A Complete Guide to Ocean Freight Procurement” webinar series. This is part three of our series. Today, we are talking about tendering best practices.

Happy to have you here all listening to us. My name is Michael Braun. I am the Director of Value Engineering at Xeneta. With me is Christian Schmans. He is our Director of Freight Management.

Christian Schmans: Hello.

Michael: Christian is our absolute data expert. He has handled about four million data points being imported into the Xeneta in this month alone. He has seen numerous and endless different tender templates from various customers. He is by far our expert to show and share with you best practices when it comes to tendering.

A quick look at our agenda for this webinar. We'll go into our standard RFQ process which we see as a good recommendation on how to run a tender and talk a little bit about that.

Then we will jump into a standard tender template, prepared by Xeneta. It shows the good points and bad points to see and best practices to be shared, to run a tender, and to do that successfully in a most efficient way.

Last but not least, we will finish with a quick look into our Xeneta app, so that you can also get the feeling of how our own product could help you analyze and run a tender.

Just to give you a little bit of a background, the ones who are not that much familiar with Xeneta yet. We are the provider of the world's largest database of tendered ocean freight rates and use this one then for up-to-date daily real‑time market analysis, to provide market levels and indexes to our customers.

So far overall, we have around 160,000 port pairs in the database, accounting now for over 55 million contracts from our customer base, being their freight forwarders and global shippers. As I said already, we get around four million new data points in there every single month, from freight forwarders and from our shipper base.

Important what I want to mention here, just as a principle. We are an independent provider of this service, so we are not linked with any participant at the ocean freight market. We're completely independent and neutral. All the information you get today is not referred to any kind of third‑party service in that context.

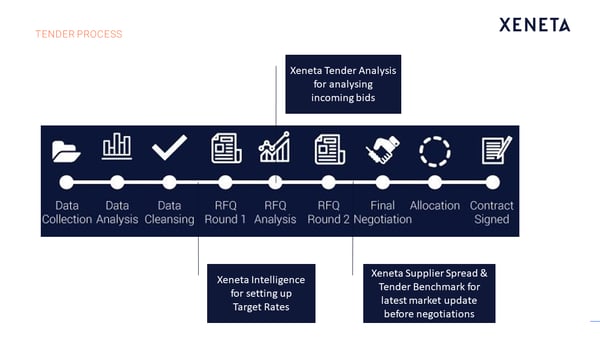

Now let's jump into our typical tender process. What we see with most of our customers is they prefer to collect data internally. Collect all of the volumes, the networks, whatever kind of service requirements you have, and then analyze this information.

What we really think is extremely important for the later transparency, and also that works are that you do a proper data cleansing so that also the service provider you ask of your tender is definitely having a good overview, and clearly understand what you're asking for.

Then there are usually a couple of runs with an analysis in between which are then followed by final negotiations together with their service providers usually face to face, and then a final allocation which is building the base for a contract sign.

Now Christian, first question, we get very often asked like what is actually the perfect setup of a tender? Two rounds. Three rounds. Five rounds. Can you share any kind of recommendations, what you perceive from our customer base?

Christian: Sure. What we see most common is two or three rounds, and I think everything above that is oftentimes quite excessive, and really unnecessary. When it comes to how many rounds you should have, obviously that depends on your needs. How complicated your tenders is? It depends a lot on your preparation.

I would say the better you prepare, and the better you're informed about where you are in the market, the fewer tender rounds you actually need. If you're using Xeneta, I think you should be able to usually do it with two rounds comfortably and get a good price in the market based on that.

Michael: What I can add here, and that's also feedback what we get especially from the carriers and the freight forwarder is that you should stick then to this prior made schedule which means that no matter if you go in with two or three rounds, you should then stick to that, and not open up four, five or six rounds.

Because in the end it just waters the efforts you have done before, and you also lose a lot of credibilities. In this context, no matter what you're set-up, it's important to scale to this kind of thing.

Now moving over, I would also like to share a couple of insights with a typical tender template. Yes, we are in the 21st century. A lot of customers are nowadays using online tools or other kinds of fancy things.

Honestly speaking, when it comes to ocean trade procurement, 99 percent of all rates are still handled in Excel because this is the by far preferred media which is handled within the ocean trade industry.

Even most of the successful and used bidding tools out there which probably have optimization engines still use the Excel template as the standardized media for collecting the rates, and then they do have upload functionalities.

This is since yes, tender templates are spread around widely across organizations both on the shipping side, and then later also on the supplier side. That's why Excel is just a common tool to be used, and we cannot recommend anything else at least for the time being.

What we have now prepared here is a little bit of a demo structure to show you what we think is necessary to ask for, but also to be limited so that you don’t get into an endless data gathering because you must never forget there are always, again, service providers who need to run a lot of effort to collect all this information.

Of course, you then later analyze it because if you then needed only part of it, you could have also only asked part of it. That's why stick to the necessary what is important, but don't overdo it in this context.

What we have seen as a good recommendation is you need to have some idea at the beginning to show a little bit the numbering, or packages so that you can later better navigate together with the service providers, or also analyze the bids.

The validity is always good to have. Of course, it's a commonly known thing within the tender, but you must not forget that this information is then later also shared with other parties. Having the validity directly in the right template is something to help.

When it comes to geography, yeah, there is not that much to be followed. What we can clearly say is bring in a country point and bring in a location point in an ideal case with a zip code so that the identification of the origin and the destination location especially if you have pre and on-carriage is identical.

Then for the medium part, it's good to have a combination of UN/LOCODES so that you just have a systematic base for ordering it. The UN/LOCODES, you can easily find on the internet.

Then also have the wording of the port so that yes, everybody just knows all of the same, and that you have a good common base for the communication with the carrier side. Having this kind of geographic information is usually enough to run the tender.

When it then comes to other aspects like incoterms and THC, I would like to refer to Christian, and he is going to have some comments over there.

Christian: Sure. Maybe let me go back very quickly to the locations. In our experience, there's a lot of different versions of the UN/LOCODES going around. If you don't use the most current one, you might also consider just leave that blank rather than making up your own codes which we have seen more than a number of times.

I think it's important to just make clear where you are and where you want to go. Often the name and the country might be actually enough. It's better than using the wrong code, and especially if you are using a city is like a port or a rail ramp let's say in a country, and you have those port locations several times.

Then you should also really make sure that you use the right UN/LOCODE because this is a common mistake. Let's see in the US, if you ship from Portland, you should know which Portland you are referring to, and just as an example.

When it comes to THC, a lot of people in the industry would say, "That's fairly simple. I will just state the incoterm, and then that's that." I think it usually helps not only to have the incoterms clear which is a definite requirement.

If you go out with your tender, you should always be very, very precise on what Incoterms you want to have the codes on. Also, you should probably specify the THC process in addition because there is some misunderstanding sometimes in the market what is to be understood from different Incoterms.

We see that because we see a lot of codes that are basically wrong in the end. Be careful that you have your Incoterms specified, and that you make clear what kind of THC you want to see in your codes.

Michael: In addition to that, it's then important to clearly state the equipment. Is it a high cube? Is it a standard? Is it dry? Is it reefer? It's well then of course an IMO class if it's applicable so that the carrier can also identify if you ship any kind of dangerous goods or not at all.

Volume is also a very critical theme. Here it's important that you of course try to get the best possible figures. I know many companies just use the figures of the year before with perhaps one or the other update, but this is of course triggering a lot later the processes on the carrier side, and in the long run, it has a huge impact also on the rate levels depending on how good your focus quality is.

In this context, that's why I explicitly wrote the period of forecast. It's important to also state what is actually the period especially when you only go out with the six months tender so that it's clear if this is now the six‑month volume or the yearly volume in this context.

Then you can see there is a big huge block about pre‑carriage. Christian, can you share there some things? We often get asked shall I ask for separate pre‑carriage costs, or shall I just ask for an all‑in rate? What is your recommendation here?

Christian: You should always ask for a breakdown here because the pre‑carriage market is very different from the sea freight market. It's like two different markets. Basically, the trucking to the ports, and the actual sea freight. If you have them together, you lose control over which costs exist, and how they are moving basically.

I would always opt for transparency on this one.

Michael: What is it about currencies? I know that you are very, very forward-thinking on that.

Christian: Yes. That's very important. I would have probably taken that with the THCs, but of course, this is true for basically every single cost you have in your template. I can strongly recommend always have if we talk Excel, a separate column for the currency.

Because if you basically force freight forwarders, or carriers to quote currencies within the same column where they also quote the actual value, so basically whatever the format, there's some accounting or something like that, you will always run into problems.

Either it's formatted wrong, or you end up with a text string neither of which you want to have there. Like an alphanumeric text string. Just make sure that you break that out so that everyone knows what you're talking about, and thereby avoid that you suddenly have pre‑carriage costs in this case of $2,000, or THCs of a few million US dollars which were supposed to be Vietnamese dong.

I have seen these countless times, so I would really strongly recommend keeping that always separate.

Michael: What I can add then here is also for later analysis, it's extremely important that when it comes to the currencies, you should have preset fields so that every carrier can just select the right abbreviation.

Like US dollar for example is the USD. Because otherwise, you would just get 5 to 10 different versions on how to write US dollar as an abbreviation which then of course makes it far more complex to later evaluate and analyze it again in this context.

Take apart what is not belonging together. That's why to take apart pre‑carriage from fuel surcharges for example. I will later say something about this, especially with the bunker topic. Then document, and export customs clearance usually should always be handled separately because sometimes these costs also apply on the BL level, and not on the original box. That's why it's good to take it apart.

When it comes over to the ocean freight, yes, Christian you already mentioned it before. What can you say about the THC topic there?

Christian: As I said, I think it's usually helpful to have them split out, but I know there are different philosophies on that one. I think the most important part really is to just make sure whether THC is included, or whether it's separate.

If you think about the different incoterms, obviously you are in a situation especially here in this example where if I remember correctly, it goes from Shanghai to Hamburg, and it's on a FOB incoterm.

You wouldn't necessarily pay the THC. Normally you wouldn't, but if it's blank, obviously everyone for your analysis, you want to know does it mean it's included in my main freight, or do I just not pay it? Or it will maybe be invoiced later separately?

Since you have usually several different bids from different providers, you may end up with a creative mix of different things. You rather want to specify very clearly what you're looking for.

Michael: On top of that, I can add that another thing which clearly needs to be kept separate is the kind of transport, or the fuel cost component of the whole transport cost. We especially see that now again how important it is due to the fact that for the first time in a long time, we are now seeing a move on the oil price which is of course directly having a significant impact also on the cost structure on the carriers.

This is a risk that if you don't want to get caught by it later, then in the middle of the contract period, and the carriers are then coming up, and raising their voice for an uproar of raise, or coming up with emergency surcharges.

You need to have a variable increment here, or just to make sure that yes, this kind of volatility can be covered by your standard contract so that you are not in the need to accept any kind of emergency berths then later on coming into the place.

If you have clearly adjusted a share of the fuel cost, of the bunker cost especially in our low sulfur, and a standard IFO 380 separated so that you have a good lever for short sea traffic which is already low sulfur today, and yes later in 2020, everything will be changed.

It's really good to have this kind of element separate, and then also align about a kind of an adjustment factor, or definitely a kind of a mechanism to know what we are going to do agreed upon both sides if the oil price is moving in one or the other direction.

That actually this risk has been calculated and is not just hidden somewhere and then pops up, and it gets really critical. That's really a very, very severe recommendation we can give you.

Christian: I think you can't overstate that especially when you think. I mean, of course, there has been the trend, especially in the last years to go for all in rates which is very practical. It's very practical to compare as well, but then you end up in situations like we currently see in the market where there are all kinds of emergency bunker PSS operation recovery.

However you call it, surprisingly enough almost all carriers came at the same time with pretty much the same amount. Obviously, you are more exposed to that kind of thing if you have an all‑in rate where everything is fixed, and the ship is contracted to market movements as Michael just said.

Consider in the start whether you might just want to opt for your own off-model from the start. Also generally in this context obviously, seeing some customers having to deal with EBS now, and others don't.

Of course, also make sure that you know the fine print of your bids so that in the end, if you want to have the security, then give them the chance to adjust bunker, but then also rule out any other adjustments like PSS or EBS or something like that.

While I'll go for the all-ended solution, but then you always potentially have the risk of either being exposed to the surcharges or getting short shipped.

Michael: Excellent. Moving over to the on‑carriage side, yeah, that's just the same like on the pre‑kit, so I will not go further into the details there. It's just mirrored the other way around and then yes, I will just like to refer to the last point, service information.

Now here, it just depends a little bit on the supply chain strategy and the necessities of your own business. Some people need to ask for transit times. If service is direct or indirect, the frequency.

What we can recommend on the cost side is to ask for demurrage and detention information because, by experience, we know that this is a huge cost factor coming afterward not really with the pure transport cost, but then later.

Having transparency here, and knowing all these elements also for good, and valid able compares enough to carriers, and service providers' bids are recommended. Here, I would also require preset data formats. No free text so that you are able to compare these issues with each other, and also derive your own calculations.

In that way, it's really strict things. Ask as much as you need, but always in a formatted way so that you can also later analyze it. Then finally, yes, we would then come to do we need free text? Yes or no. Do we allow comments? Yes or no. What is your recommendation on that topic, Christian?

Christian: I think this is a really difficult question because obviously I really like clean data. Ideally, you can only compare the numbers, but unfortunately, that's usually not how the world is.

You basically must decide when you set up your tender how much freedom you want to give to the people filling out the bids. Obviously, you should be careful that you don't allow basically text strings everywhere.

As I mentioned earlier, you might end up with the currencies in the value columns, and all those kinds of things. If you are too restrictive, people get creative by filling out the bids, or you might lose important information, and just get some conditions, and addition somehow as submitted from the different carriers of freight forwarders.

While I'm really not a big fan obviously of free text and random comments, I do recommend giving at least some out for that kind of thing because they might have restrictions there. Someone might not want to use Shanghai, but a port close by.

If you can't give that information anywhere, the quality of your bids won't be good either. Obviously, while I would discourage using the commons too much, I think it's always good to give an outlet so that people can express something if it doesn't fit in the template because otherwise, you just have problems afterward.

Michael: I think to the point that yes, you should ask for many details. Then in a structured format with probably this one very last loophole to just sum it up in that way, and not to make it too complicated.

Because then it must be handled on the personal negotiation side, or you get a side letter next to it which is also overcomplicating it. Then it's better to actually have it covered within the Excel sheet.

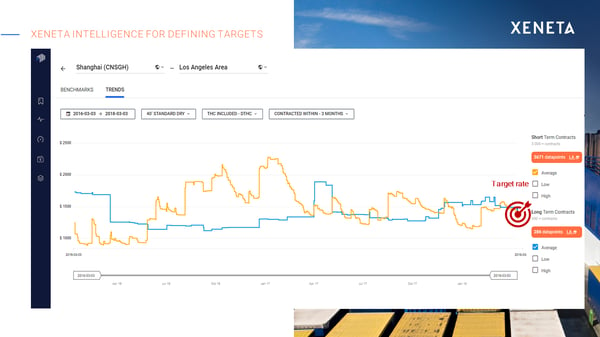

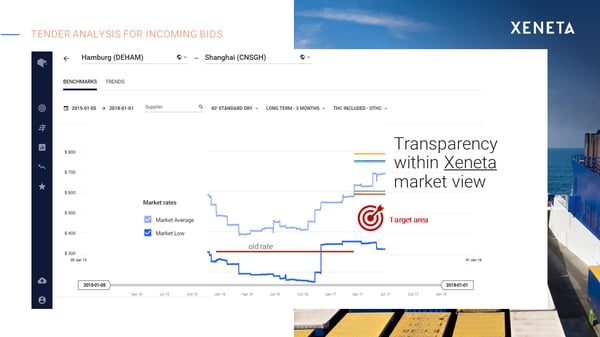

Now moving over, giving you a couple of insights, and how you could use our rep with this kind of tender management or tender analysis. There are three elements which are mostly used by our customers. The first one, Christian has already mentioned. Yes, depending on your market insights, and the preparations, target settings.

Of course, the ones of our customers which are using Xeneta, then having the intelligence out of that one already has a very good profound idea of where the market is currently moving. In that way, they are also able to set up target rates even before the first round.

They don't need an initial round to just get an idea of where the market is moving and collect these widespread replies from the carrier base. That's why that also drives a little bit how many rounds you need, and the ones using our intelligence are usually able to skip this very first round where you just do a kind of pure information gather.

Then finally bigger part of course - the real tender analysis. When the bids are coming back. How do you look at that one and then last as negotiations move on?

Also when you are in the middle of the negotiations or playing your tactics, our new feature supplier spread as well as with the latest tender benchmark are good elements we think to support you in your tender analysis.

What does it mean? With Xeneta data, and so in this context, Xeneta Intelligence, you get an overview of where the market is moving. For example, in Shanghai to Los Angeles or Transpacific, short and long-term market movements.

This of course gives you an area that you know where your bids are going. If you want to already structure the income of your bids, and set up target rates here, it just gives you a very good profound analysis of where you expect the rates to be, and the corridor you are looking for, so you don't need to have any more of this kind of additional bidding rounds. A lot of our intelligence customers are using that data for this.

The next point then is the tender analysis. Of course, you can do very profound Excel calculations, but it makes a little bit of a difference if you also display it electronically. Here you of course have sometimes very sophisticated tender analysis tools.

By playing it in Xeneta, and in our app one more feature is coming. I'll just show you how a typical rate input could look like when you have this kind of normal transparency within your own market view.

You have your old rate coming in from the past, and then you will get all of the new offers coming in, and you can do calculations. That's also what all of the tender tools can do on the market.

What we now can put on top is just mirror this kind of development, what you see within your own tender, and you see with your own market to the overall market development. This of course gives you a completely different indication on where all the bids are lying, and where you should probably focus on with your later on negotiation area and both ways.

Then define upon yes, how aggressive do I want to go in? Do I want to stay on the average level, or do I want to go further down below? It also gives transparency the other way around so you can also see for example that towards this is late period, you have actually been below market lower level.

The carriers shipped you below the market level in this context. Also paid against them in that way, and that's of course also a valuable input to know for your negotiations because it's not always just about bidding down prices or whatever.

It's just getting the transparency, and then also understanding that there are probably times where you have been excellently off with your old rate levels in that context. It just gives a lot more transparency than by just looking at the pure isolated tender picture. What you have seen before, and that's why a couple of our customers are using this element when it comes to the total analysis of their tender.

Finally, that's also a good point even though in the second round. You can also flag outliers. If you see where the current market is, and You have one extreme rate really falling apart, it can also give you technical help to really check this rate, and to make sure is it realistic? Do we have a currency mistake? Does the carrier really understand the required process?

Because if he's so far away, and significantly below market level, the chances are unfortunately higher than at the end, this rate will not be carried out in the way how it was offered in this context. I think that's a very good well‑known experience, what Christian also sees with all the rate tricks we are doing.

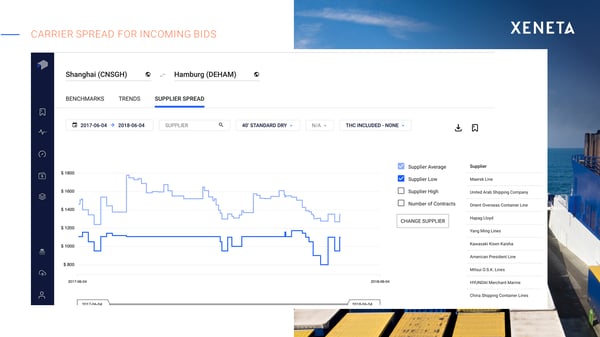

Another feature we are now announcing that is also good to prepare negotiations is our new carrier spread. Herewith this feature you are able to not only show the market spread but also a specific spread of only one supplier.

Especially when it comes down to comparing suppliers. Endless discussions about high service suppliers with good transit times and networks, and other ones which appear to be not, here you can get a clear comparison on the supplier level what we do have as market average and lower rates so that you can really evaluate if this kind of service requirements have an impact on the pricing.

You can of course also then measure it with the corresponding offers of the carriers. Also, a very good element on that side that you really get clear transparency even down on the specific carrier you are probably having next to you in the negotiations. It also explains a lot of the background with these things.

Then finally, that's always a question we get asked. You have a lot of powerful information in the tool, but of course, your tender is running extra. Is there also a possibility to use this information to play it back into the Excel tool? Here, I would just bring it back to Christian to explain a little bit more of the details.

Christian: Sure. If you basically prepare your tender, and you want to have what Michael had touched upon several times, if you want to have basically your baseline defined by where the market currently is in Xeneta which is obviously definitely what as I said earlier, you can do it with Xeneta in two rounds.

I think this is probably where you save the most time by just aligning to realistic market expectations. The first round of tenders is not completely off. If you want us to basically give you those benchmarks, what we obviously need is a clean port of origin and a clean port of destination. A clear indication of which equipment time we're talking about, and what kind of THC methodology you want to have. Then obviously the values we give you are comparable to the bids you will get.

We can do that. We populate all kinds of Excel formats if necessary. We usually need roughly one week as a turnaround time. It also helps to consult as basically in good time, and not like a day before you want to send and it out, but yeah.

That's in general what we can do for you, and we try obviously our best to do that as fast as we can. The cleaner the dataset we get faster it goes.

Michael: It's a maximum of a week that we need, so you can really feed it into your tender structure because usually you also have some time in between the rounds to cover these things, and then you will directly get the necessary market levels fitting into your own tender environment.

Also, adjust it to your own tender methodology so that you get just a perfect spoon‑fed delivery of the necessary market data and transparency to populate your tender and then run it very efficiently. That's, of course, the goal to say of everybody to run smooth and efficient tenders in a very fast way.

As long as you still run tenders and not, for example, link it to index‑based pricing because it just reduces a lot the capacities on both sides, and this is of course also in the interest of the supplier base. Thanks, Christian for your very valuable insights. It was a pleasure.

We hope that you enjoyed the session as well as we did and that you could take out one or the other experience and best practice we could share with you, and just, of course, we also hope if you use our solution to further support you in your daily business.

This webinar is the third part of the "A Complete Guide to Ocean Freight Procurement" webinar series.

###

If you missed any of our webinars – or simply want to refresh your memory – you can access all of them on-demand here.

.png)