In our latest customer-exclusive webinar we explored critical trends in the ocean freight market, alongside special guest Rita Florit Macau, Sourcing Director, Indirect of DSM Firmenich. With her wealth of experience in global logistics, Barcelona-based Rita shared some great insights on how to effectively managing supplier relationships and stakeholder expectations in a heavy market.

Speaking on day 45 of the DSM Firmenich merger, Rita says tying the knot between two global companies with different mindsets presents both challenges and big opportunities. Her focus is on working together with new colleagues to identify and maximize synergies.

‘Attack rate forecasting from all angles’

Given that freight rate forecasting is complex at the best of times, Rita’s key message is to combine a variety of approaches rather than rely on a single method. This includes historical analysis to identify trends/seasonality, looking at macroeconomic indicators like GDP and supply/demand statistics, as well assoliciting insights from industry experts and market intelligence platforms.

She stresses the importance of involving value-chain stakeholders in decision-making, forging strong long-term relationships with carriers and service providers, and maintaining a strong focus on continuous improvement and supply chain innovation.

Regarding the need to balance competitive pricing and service reliability for end-customers, Rita says it really depends on the nature of the industry. She notes that, whereas in the past people’s main priority was chasing the lowest possible rates, today procurement executives have more freedom because wise managers recognise the correlation between robust supplier relationships and superior service.

On the thorny issue of sticking to fixed-rate RFQs in future or relying more on index-linked contracts, Rita’s approach is to map out as many relevant scenarios as possible. No one has a crystal ball to predict the future, which is why it’s a must to get input from many sources. She says DSM Firmenich has implemented various mechanisms to capture maximum value from the current market, without divulging specifics.

Poll confirms growing popularity of mixed approach

We don’t know when the next Black Swan event will come, but companies on both sides of the divide need to be prepared. Our poll results showed some differentiation between being opportunistic and closer to the market on the one hand, and doing a blend of indexes and fixed-rate contracts on the others – which resonates well with what we perceive to be the position of our Beneficial Cargo Owner (BCO) customer base. Of the respondents, 65% either run the normal RFQs or simply play the long and short-term market, while 30% use a combination of both. What surprised us is that no one is relying 100% on indexing presumably for fear of putting all their eggs in one basket.

Market volatility likely here to stay

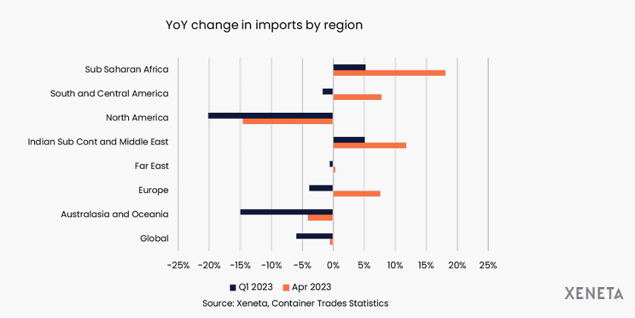

Looking at import volume development in different regions for the first quarter versus April provides a few interesting takeaways. All regions saw better development in April but some are still declining overall.

Q1 volumes fell significantly in North America year on year, although softening somewhat in April. The huge drop in demand is food for thought considering the US remains the world’s largest consumer market and the main driver for ocean freight. We’ve got more on the dynamics at play here in our latest Ocean Deep Dive Report (add link).

Meanwhile, April volumes for Sub-Saharan Africa, South and Central America, and Indian Sub Continent and Middle East increased significantly. You can’t draw firm conclusions from just one month, but this softening in growing markets is heartening. Europe’s April score also provides encouragement.

It will be interesting to see how our BCO customers’ volume forecasts actually pan out in 2023. Just over 20% are beating our forecasts, but the rest are still going below. That’s an indication that the worst is not yet over, with the gloomy outlook confirming the trend from Q4 2022.

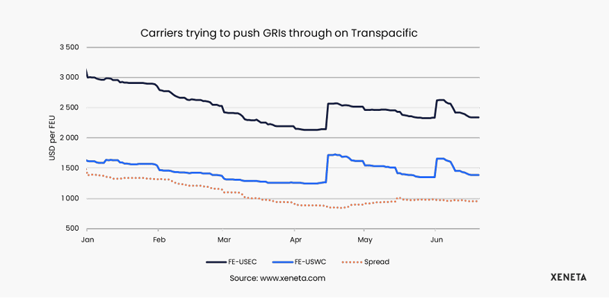

GRIs fail to stick

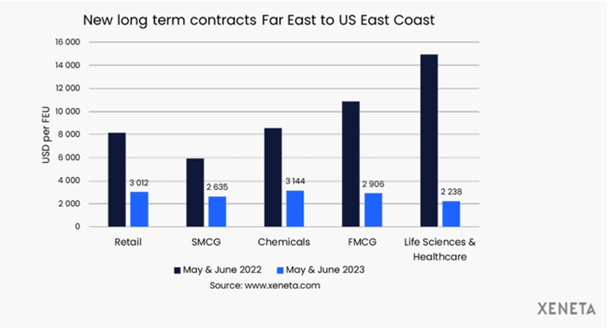

Transpacific rates to the US West Coast (USWC) and US East Coast (USEC) are another good illustration of the weak market, with a couple of unsuccessful attempts by carriers to push through GRIs in April/May and at the start of June. They would’ve stuck if the market was fundamentally stronger.

The outlook is worse for the long-term contract market. The wide rate spread we saw last year was driven mainly by supply-chain disruptions, with BCOs of high-value goods in life science and health care especially willing to pay a premium. These are now pretty much over, with no more big pressure on Far East-USEC, which was the last trade with congestion. Both trades are now much closer to each other.

The fact that companies seem not to be exerting strong pressure on the cost side, as they were able to do historically, is a clear signal that any kind of rate boom is over. We're also talking May and June here, so the trend already involves drought in the Panama Canal. It’s also valid across all major industries.

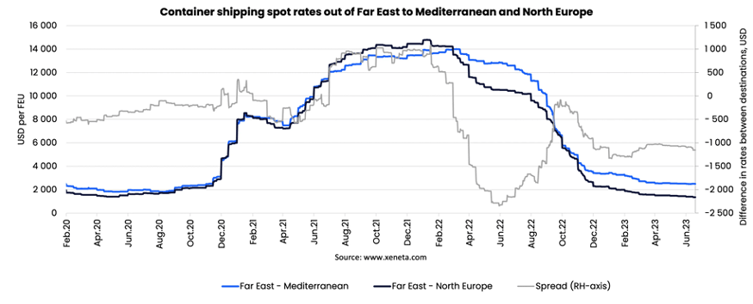

Big spread in spot rates from Far East to Europe

Shifting the lens to spot rates from main ports in the Far East to the Mediterranean and North Europe, between 2015 and 2019 the delta between these two trades was USD 100, give or take. It was hovering around that point as we went into COVID, then shot up to USD 1,000 and peaked in December 2021/February 2022. It then dropped in June 2022 to negative USD 2,500 before rising back close to zero in October 2002.

That is where we anticipated rates would stabilise, but the delta is now more than $1,000, which almost seems to be the new norm. Even with no GRIs, it’s interesting to see such a huge dollar spread between these trades, given their historic and ongoing high correlation pattern-wise.

We believe the driving factors here are related, on the one hand, to more ported volumes going into the Med than anticipated, and on the other, stronger downward pressure from some carriers when it comes to how low they're willing to price.

For example, from Far East Main to North Europe Main, the carrier (Maersk Line) average for long-term contracts is USD 8,484 while the market average is USD 9,0977. Maersk was pricing below the market average 12 months ago when the market was very healthy, but for the past 10 months they've been trying to hold the market up. This compares with HMM, which was pricing above the market average a years ago, but has now been pushing the market down for a significant period.

On Med side, MSC is also being quite aggressive on price, probably wanting to grab market share to fill all their capacity. But this of course drives down rates.

Addressing the outlook for long-term contracts, already agreed long-term contracts are valid until September 2024, way beyond this year’s tender season. There’s clearly no uptick and carriers will be wondering when supply/demand equilibrium will be restored. Meanwhile, buyers are reaping the benefits and may be expecting even more reductions.

We will likely see the same trend in other trades, for example Far East-North Europe. The market has been low, but stable, at around USD 1,400 for almost six months, maybe reflecting carriers’ efforts to stem the downward slide. However, the rate per FEU isn’t good enough to make decent profits. We also question the carriers’ strategy to get the market back to a healthier state; there are so few of them with too much capacity, with more being deployed and not enough ships being removed. This opens the door for shippers to extract further savings. Given that many shippers are also struggling, they’ll be wanting to squeeze out every possible dollar to shore up their bottom lines.

No expectations market will return to elevated levels

Apart from some softening factors, for example on the Transatlantic-USEC trade where long-term contracts have also plateaued for the past six months, with no further reductions, there are precious few signals of improvement on the demand side. Do people think the market will bounce back in the second half? Our poll on this showed 61% of respondents believe conditions will remain soft until at least Chinese New Year (i.e., into the tender season), while 33% think it will improve but with no strong peak season. This aligns with our view. Some buyers may still see opportunities for further costs reductions if they close long-term contracts early in season before the market fully materialises. Those with indexed contracts may also see some downward adjustments later on.

So, it’s clearly a buyers’ market and most stakeholders seem to think nothing will change, at least in the short term.

Red flag for carriers on world’s largest trade

Finally, returning to the Far East-USWC trade, the long-term contract average is still sitting above the short-term market average – also after two failed GRIs. This likely won’t be the case for long, as volume players will be unhappy paying above small volume players when they start negotiating new contracts. They were happy to scoop big reductions as of last year, but will baulk at Mom-and-Pop importers paying less with no volume commitment. This will create further noise for the carriers; if they don’t manage to push through some GRIs to above the long-term average, the buyers’ market will just get stronger.

.png)