Sound the klaxon, ring the bell, because for the first time in 14 months the spot rate on the Transatlantic fronthaul has risen above the long term market.

Last year, we described the Transatlantic as being ‘like an unwelcome guest at a dinner party’ as carriers used it as a parking lot for excess capacity on other trades and rates continued to tumble.

Let’s investigate the prime suspects responsible for this turnaround.

A ripple effect from the Red Sea crisis perhaps? Has there been an increase in demand? Maybe carriers are now better managing capacity to match the requirements of shippers?

There is also the introduction of EU ETS regulations in 2024 which do not favor those vessels operating at sub-optimal capacity.

Suspect 1: Demand

Firstly, let’s look at demand. Since peaking in October 2021 (source: Container Trades Statistics) demand has fallen every month when compared to the previous year. For the full year January to December 2023, demand fell by 13.7% compared to 2022.

To give an indication of how steady this decline has been, the average decrease in demand in the final seven months of 2023, when compared to the corresponding period in 2022, was also 13.7% (source: Container Trades Statistics).

Overall, this represents a five-year low for annual demand on this fronthaul North Atlantic trade lane.

So, no smoking gun to be found in demand to account for the Transatlantic turnaround.

Suspect 2: Capacity

While demand on this trade has been fairly predictable in its demise, the same certainly cannot be said for capacity.

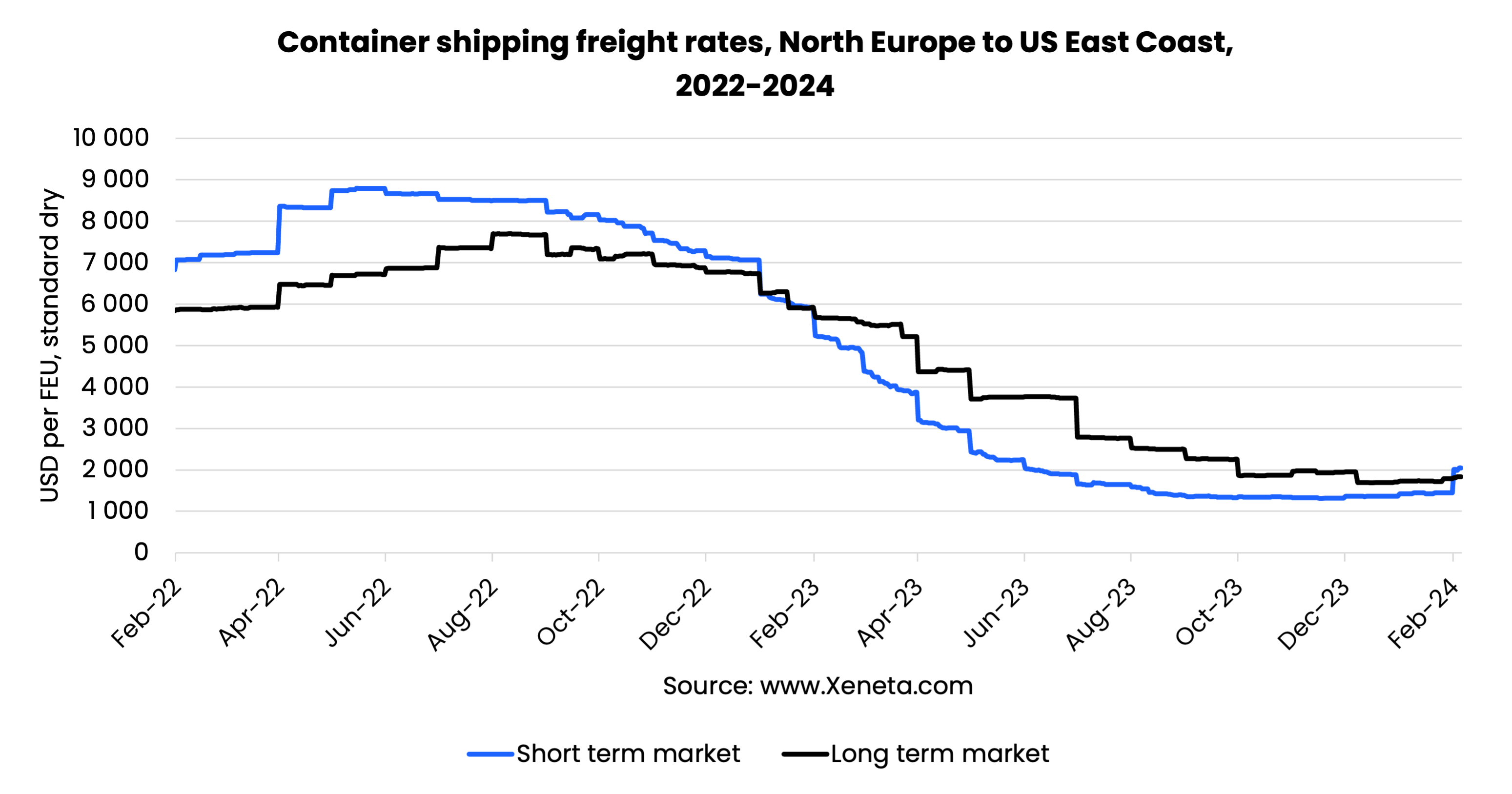

Carriers drowned this trade with capacity in the first eight months of 2023 and spot market freight rates reacted accordingly. From just over USD 7 000 per FEU at the end of 2022, rates hit an all-time low by mid-November at USD 1 318 per FEU. This is a drop of 81.3% in 315 days.

The magnitude of the decline eased between August and November but the direction was the same – downward.

If the flooding of capacity on this trade was responsible for the collapse in rates then it stands to reason it is a key reason for them starting to increase again.

Smarter carrier tactics regarding capacity management became a focal point in Q4 2023 and remains the primary factor in the lifting of rates in February 2024, which saw an 18-month low for deployed capacity on this trade. This is based on a four-week rolling average adjusting announced capacity for blank sailings.

Suspects 3 & 4: The Red Sea Crisis and EU ETS regulations

If we have established capacity management is responsible for increasing spot rates, can we close the case? Not quite because there are accomplices for us to consider.

The Red Sea crisis is impacting trades beyond those that transit the Suez Canal most regularly. As carriers re-route all but a few services around the Cape of Good Hope in Africa, sailing time increases by at least 10 days on each leg of the journey depending on the country of origin and destination.

This means more vessels are required to maintain service schedules. Perhaps this plays into carriers’ hands, allowing them to reduce capacity of the Transatlantic while increasing capacity on services diverted around Africa – thus solving two problems at the same time.

EU ETS regulations have also been introduced more fully in 2024 and will impact carriers (and shippers through surcharges) most severely on trades with poorer load factors. However, the financial implications of EU ETS surcharges introduced by carriers pale in comparison to the costs associated with disruption in the Red Sea and Suez Canal.

So, while EU ETS regulations will be a consideration for carriers in reducing capacity on the Transatlantic, it is not likely to be the primary motive in their decision-making at present.

You can read more about EU ETS regulations here with a further update for Xeneta customers coming soon.

Where do rates go from here?

Early indications on the Xeneta platform point towards spot rates climbing further by a small amount in February – if carriers can convince shippers to take the announced GRIs.

However, that will be easier said than done, especially if those major trades impacted by the Red Sea crisis are anything to go by, with shippers seemingly negotiating carriers down on the early February GRIs. You can read more on that on the Xeneta Red Sea Crisis Newsfeed here.

Xeneta customers can view the development of spot rates on the Transatlantic in real time on our platform – and it is sure to be an interesting first half to 2024 on the trade.

Want more?

Download the 4 Steps Shippers Can Take Now’ providing a range of advice and insight to help navigate the ongoing crisis, such as support for internal meetings with CFOs, preparing to use more air freight and understanding the risks to your supply chain here.

.png)