XENETA WEEKLY OCEAN CONTAINER SHIPPING MARKET UPDATE - 7.11.25

PLEASE NOTE: The Xeneta weekly update now includes offered capacity data on the five major fronthaul trades along with average spot rate data.

Quotes from Xeneta Chief Analyst Peter Sand are provided beneath the data highlights.

Data highlights

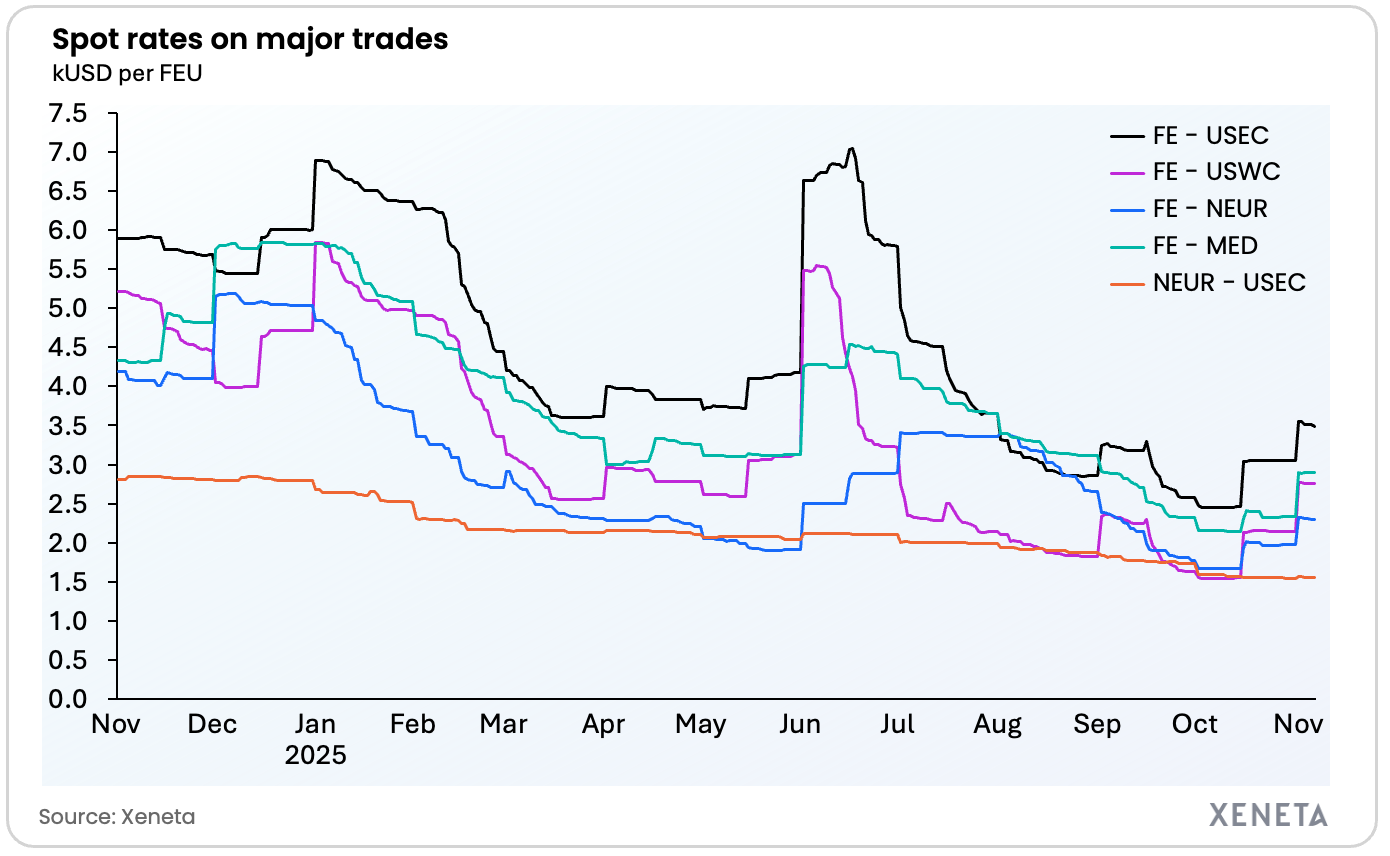

- Market average spot rates – 6 November 2025:

- Far East to US West Coast: USD 2756 per FEU (40ft container)

- Far East to US East Coast: USD 3492 per FEU

- Far East to North Europe: USD 2293 per FEU

- Far East to Mediterranean: USD 2899 per FEU

- North Europe to US East Coast: USD 1558 per FEU

- Offered capacity (4 week rolling average) – 3-9 November 2025:

- Far East to US West Coast: +4.1% from a week ago / -5.5% from one month ago

- Far East to US East Coast: -0.7% from a week ago / -4.4% from one month ago

- Far East to North Europe: -5.8% from a week ago / -11.9% from one month ago

- Far East to Mediterranean: -1.0% from a week ago / -7.5% from one month ago

- North Europe to US East Coast: +19.8% from a week ago / +1.8% from one month ago

- Upward and downward movement in offered capacity from carriers across the five main fronthauls in the past week. Largest increase found on Transatlantic fronthaul (up 19.8%), reversing capacity reductions seen in the second half of October.

- Largest decrease in offered capacity from Far East to North Europe, down 5.8%.

- Diverging trends in offered capacity on US-bound trades from Far East. Transpacific into US West Coast up 4.1% while decreasing 0.7% into US East Coast.

- When comparing offered capacity into Europe and US from the Far East to one month ago – the trend is falling. Largest drop into North Europe, down 11.9%, and smallest drop into US East Coast, down 4.4%.

- Average spot rates on all main fronthauls out of the Far East increased significantly in the past week, with the Transatlantic also inching upwards.

- Highest week-on-week jump in average spot rates on the Far East to US West Coast, up 28.2% from 30 October. Closely followed by Far East to Mediterranean, up 24.4% and reaching a two-month high at USD 2899 per FEU.

- Spread in spot rates between trades from Far East to US West Coast and US East Coast has narrowed significantly, reaching a one-year-low at USD 736 per FEU on 6 November.

- Narrowing spread between US coasts results from carriers’ relatively ‘successful’ GRI-implementation from the start of November, with higher gains into US West Coast (+USD 626 per FEU) against US East Coast (+USD 500 per FEU). The higher exposure of the US West Coast to US-China geopolitical development is behind this.

Xeneta analyst insight

Peter Sand, Xeneta Chief Analyst:

“If you want to understand the dynamics in ocean container shipping right now – just look at the relationship between offered capacity and freight rates on the major fronthaul trades.

“Offered capacity is down across all major fronthauls compared to a month ago, despite increases on some trades in the past week.

“Clearly, carriers are managing capacity very carefully at an important time of year ahead of 2026 contract tenders and this has contributed to average spot rates increasing again on 1 November after an earlier uptick in mid-October.

“There were similar spot rate upticks on 1 November 2024 and 1 November 2023 – this is not a coincidence, it is carriers doing what they do best at a crucial time of year. Carriers will be pleased with their work of late, but they are battling subdued demand no matter how well they manage capacity, so it is likely gravity starts to win and rates fall back.

“The spread in average spot rates between the US-bound fronthauls has reached a one-year low, driven by higher gains into the US West Coast compared to the US East Coast. The truce between US and China is a key factor in this, with the trade into US West Coast historically more sensitive to geopolitics between the two nations. It also explains why carriers have increased offered capacity slightly on this trade in the past week.”

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts:

Philip Hennessey

Director of External Communications

Xeneta

+44 7830 021808

press@xeneta.com