Winter has arrived and airlines are adjusting flight schedules to reflect traditional passenger demand at this time of year.

What impact will this have on air cargo rates between Europe and US – a corridor which is particularly sensitive to seasonal factors?

Reduced belly capacity in winter season

Europe and the US were among the first regions to lift Covid restrictions in the first half of 2022, more than a year before many Northeast Asia countries.

This gave Europe and the US a head start in recovering air cargo services, and in summer this year capacity between these two regions exceeded pre-pandemic levels.

We have also seen normality return in terms of flight schedules, with airlines resuming classic seasonal patterns which build towards the start of the winter season on 29 October.

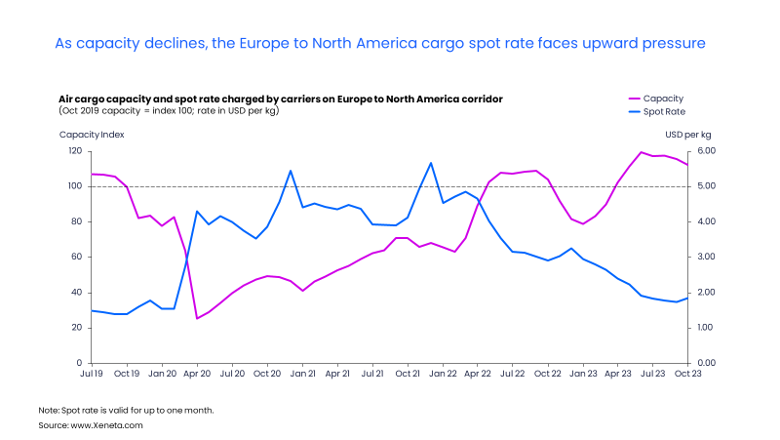

Transatlantic air freight corridors are fairly unique in that they are highly exposed to seasonal factors due to a heavy reliance on belly capacity. With fewer passengers travelling in winter, airlines scale back passenger flights, meaning less capacity for air cargo.

Reduced capacity in winter is coupled with the traditional air cargo year-end peak season, with spot rates (valid for up to one month) and seasonal rates (valid for over one month) facing upward pressure in Q4.

This pattern appears to be rock solid, with spikes in rates during November and December on the Transatlantic front haul observed pre-pandemic, throughout the Covid years of 2020 and 2021, as well as last year.

There is no reason to suggest this year will be any different, with lower belly capacity placing upward pressure on freight rates. Spot rates were USD 1.94 per kg at the end of October, and will rise to further close the gap with seasonal rates – potentially being on par during November and December.

No sign of traditional peak season demand

While spot rates will increase due to reduced belly capacity during winter, they will be impacted less by demand for air cargo. October data from the Eurozone Manufacturing Purchasing Managers’ Index and high inflation in the US cast doubts on a return to tradition peak season increases in demand.

Demand for air freight is impacted further by improving schedule reliability and lower rates in ocean freight shipping. This situation could change in the event of another black swan event (for example another pandemic or war), but for the time being it appears ocean freight is becoming a more attractive proposition for many shippers.

Shippers move towards longer agreements as rates fall

While the upstream market saw rates increase, we saw the opposite in the downstream air cargo rates paid by shippers.

Shippers are moving away from short-term rates and fixing into longer term agreements with freight forwarders (typically between six and nine months). In the first week of November the general air cargo rate from Europe to US continued to trend downwards to USD 2.17 per kg for 500+ kg non-expedited service.

The industry is yet to see the peak season surcharges, traditionally introduced by freight forwarders, have any meaningful impact on long term rates.

This strengthens the view that air cargo demand will break with tradition and remain muted for the rest of the year.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

.png)