The bigger they are the harder they fall? Although the air cargo trade between Europe and the Middle East ranks as one of the top global routes, the outlook is far from positive for ongoing spot rate developments. According to Xeneta’s analysis, rates have been under pressure since the second half of last year… and carriers shouldn’t get their hopes up for the remainder of 2023.

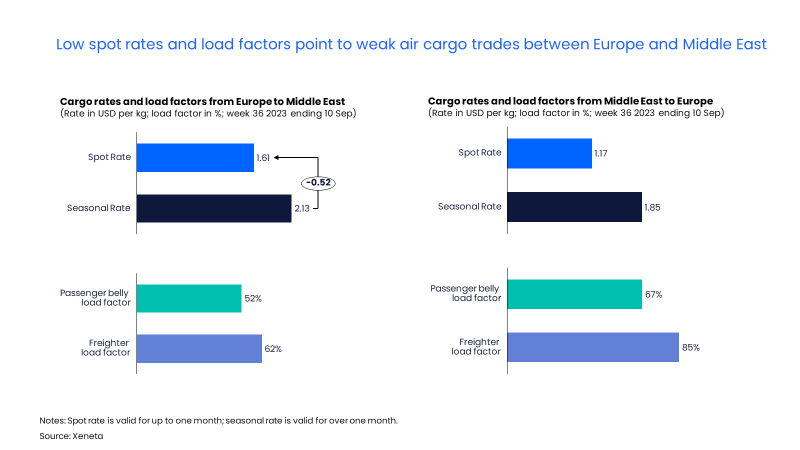

The air cargo spot rate for Europe to the Middle East stood at ‘just’ USD 1.61 per kg for the week ending 10 September. That’s a significant shortfall of 52 cents per kg against the seasonal rate.

The cargo load factor reflects the current state of the market, hitting its lowest level since the onset of pandemic. With increased capacity on the networks, passenger belly load factor dropped to 52% for the week, with the freighter load factor following suit down to 62%.

Looking at the westbound trade from the Middle East to Europe, the air spot rate managed only USD 1.17 per kg in the same week, with the rate falling back to pre-pandemic levels.

East versus West

Rates on the eastbound route are usually more expensive than its westbound counterpart, largely due to a clear trade imbalance, with far greater volumes originating from Europe than the Middle East. This is also why we see air freight rates from Europe to the Middle East commanding a premium over rates from Europe to Asia, although the latter faces higher operating costs. The depth of demand in the Middle East ensures yields are higher here than with Asian destinations.

The Asian influence

It's worth noting that even though westbound rates are cheaper than eastbound prices, cargo load factors from the westbound trade usually outstrip the eastbound trade. This is because the Middle East is a strategic transit hub for many airlines with cargo flows from Asia, with its importance boosted after the onset of the Ukraine war in February last year.

In the week ending 10 September, the passenger belly load factor from the Middle East to Europe reached 67%, with freighter load factor at 85%. Thanks to massive volumes of cargo arriving from Asia, it’s not surprising to see that Middle East to Europe spot rates have fallen to pre-pandemic levels, while still achieving much higher load factors than on eastbound trades.

Subdued outlook

It’s difficult to see how air cargo trade between Europe and the Middle East will escape from the doldrums anytime soon.

Both the International Monetary Fund (IMF) and the World Bank project slower GDP growth in the Middle East this year, with the IMF, for instance, expecting a 3.1% growth in 2023, compared to 5.3% last year. This is in line with the recent voluntary oil production cuts from OPEC+, hinting at a weaker economic outlook for the remainder of 2023.

Bearing this in mind, air cargo rates between Europe and Middle East may have to wait for carriers to reduce capacity at the end of October – the beginning of the winter season – to get the desired boost.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

.png)