With peak season on the horizon, stable spot rates, and signs of recovery in the ocean freight rate market, are the stars aligning for higher air cargo spot rates from China to Europe?

A return to stability?

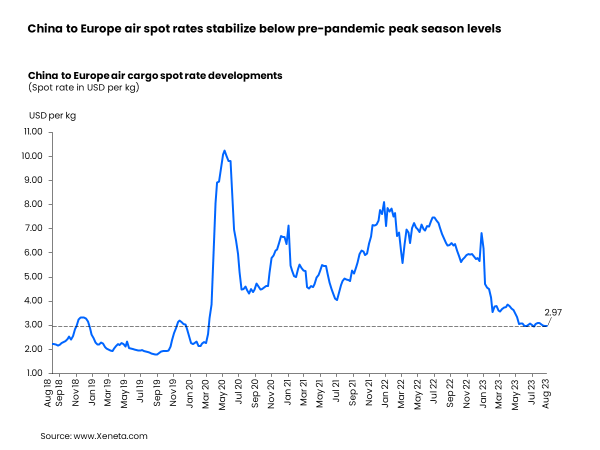

Air cargo spot rates from China to Europe have stabilized over the summer period, with rates hovering around USD 3.02 per kg since mid-May. This suggests somewhat of a return to a pre-pandemic pattern, whereby the market flattens in slack summer months before picking up in the last week of August/first week of September ahead of the November/December peak season.

Both air cargo capacity and volumes on the corridor have picked up from last year’s levels after China lifted its covid restrictions in January this year. It is also interesting to note that a downward trend of the air spot rates has so far been avoided, with rates stabilizing at the lower end. This has occurred despite year-on-year changes of air cargo capacity, which have been growing at a faster pace than volume changes in recent months.

Spot rates down to pre-pandemic peak season level

Looking closer at the week ending 27 August, the average spot rate from China to Europe fell to its lowest point since the onset of the pandemic, at USD 2.97 per kg. This level is also below the year-end peak season of 2018 and 2019. Despite this new nadir, the rate this week remains 50% above the average seen at the same point in 2018-2019.

Looking at general cargo only, the spot rate stood at USD 2.62 per kg in the last week of August and was only 21% above its pre-pandemic 2018 level. This, to some degree, explains the recent stabilization of the air cargo rates, as the general cargo spot rate closes the gap with pre-pandemic levels.

Eyes on the skies ahead of peak season

As the rates stabilize, Xeneta data reveals that the share of air cargo volumes allocated to the spot market has fallen from 59% in early May to 48% by the end of August, with freight forwarders reducing their volume purchases in the speculative spot market.

With the peak season looming large on the horizon, freight buyers might want to ‘fasten their seatbelts’ and finalize strategies. Xeneta reported in its latest ocean blog “the winds of change may be blowing in the ocean freight market, albeit with just a gentle breeze (for now), as spot rates between the Far East and North Europe move above long-term contracted prices” on the main Far East to North Europe corridor.

This is relevant for air freight buyers as the ocean container freight market tends to begin its yearly peak season a few months ahead of the air market. Therefore, an uptick in ocean spot rates for the fronthaul Far East corridor hints that we may expect some modest spot rate growth for the air freight peak season later this year too.

With this in mind, it will pay (quite literally) to monitor the upcoming weeks and be on top of any larger swings in freight rates. Remember, in pre-pandemic years the air spot rate used to pick up during the last week of August, or the first week of September, so keep your eyes peeled for the latest data to see if history repeats itself.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

.png)