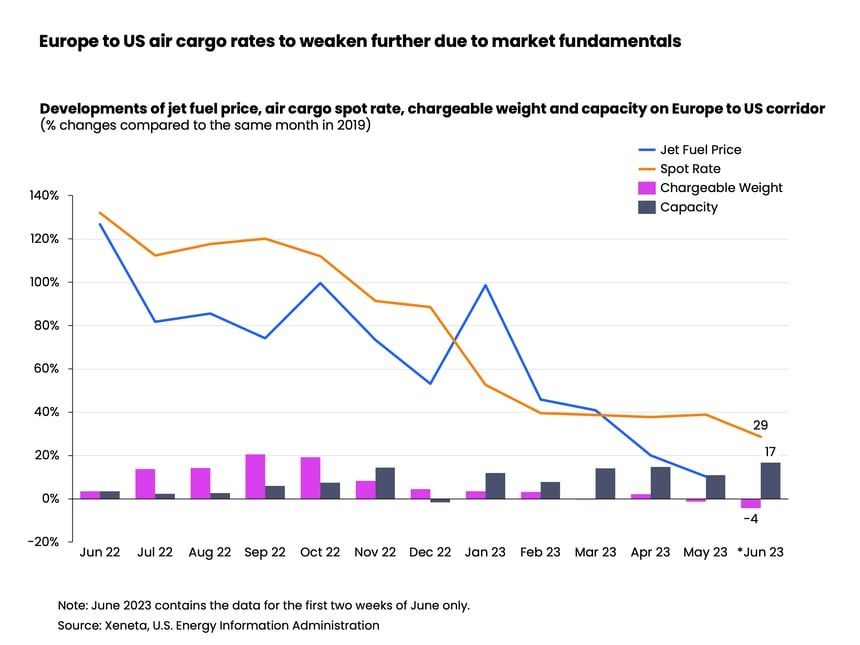

Since reaching a high in December 2022, the air freight spot rate from Europe to the US has fallen by 65% this year. In June (or until 18 June) the rate stood at USD 1.96 per kg, 29% higher than the same period in 2019, but still lower than global rates.

Downward pressure on the Europe-US corridor will likely continue in the third quarter, mainly due to higher cargo-carrying capacity, which is closely related to passenger seasonality (leisure travel during summer holidays in the Northern Hemisphere).

Since April, westbound transatlantic cargo capacity has increased by 30% compared to airlines’ winter season from the end of October to end of March. The corridor was one of the first to recover following the pandemic lockdowns, with available cargo capacity in May surpassing the corresponding 2019 level by 11%.

Weaker demand on this trade has also contributed to declining freight rates. Chargeable weight in May decreased by 15% from the same time a year ago. It was also 1% lower than the pre-pandemic 2019 level, which was, moreover, a trough year for the air cargo industry. Given current market indicators, we expect freight volumes on the trade to bottom out in the July-August period.

Aside from current overcapacity in the market, the falling spot rate can also be attributed to the underlying cost structure of air freight services. Jet fuel is one of the top cost elements, accounting for some 25% of airlines’ operating expenses. However, a bit of cost-heat has come off as the price of US Gulf Coast kerosene fell by 47% from its peak in June 2022 to USD 2.173 per gallon in May.

However, the jet fuel price was still 10% above its 2019 level due to a surge in demand compounded by high inflation. But in comparison to the US Consumer Price Index (CPI), the May price compared to the same month in 2019 was 9 percentage points lower than CPI growth ratio (+19%). This also partially explains the reason for the spot rate remaining 39% above its pre-pandemic level in May.

Weak peak season expected

Looking further ahead, this year’s year-end peak season from September onwards is likely to be muted for the Europe-US trade after its exceptional peak last year.

Peak-season cargo volumes from September to November last year jumped by 14% and 16% from 2021 and 2019 levels, respectively. However, 2023’s year-to-date cargo volumes have fallen by 8% versus the same period last year and are on par with the same period in 2019 – again, a weak year for air cargo.

We expect the Europe-US rate to experience only a slight uptick, but to remain above 2019 levels. This is due to both muted cargo demand and lower jet fuel prices compared to 2022, which are unlikely to provide enough thrust to boost the current air freight rate. Ongoing pressure from labor shortages and rising labor costs is also likely to drag on. However, year-end cargo capacity adjustments resulting from airlines’ winter season starting from the end of October should pull some overcapacity out of the market and limit the potential for further rate falls.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

.png)