In February, many airlines are relaunching contract negotiations with freight forwarders for contracts starting around 1 April. This coincides with the start of the airlines' summer schedules, from 26 March 2023 to 28 October 2023.

With the air cargo industry starting to normalize, all eyes are on this year's summer season to see how much capacity this will bring and at what rate levels.

In January 2023, global air cargo capacity was only 2% below pre-pandemic levels, so capacity levels from 2019 can shed some light on what to expect in the upcoming summer season.

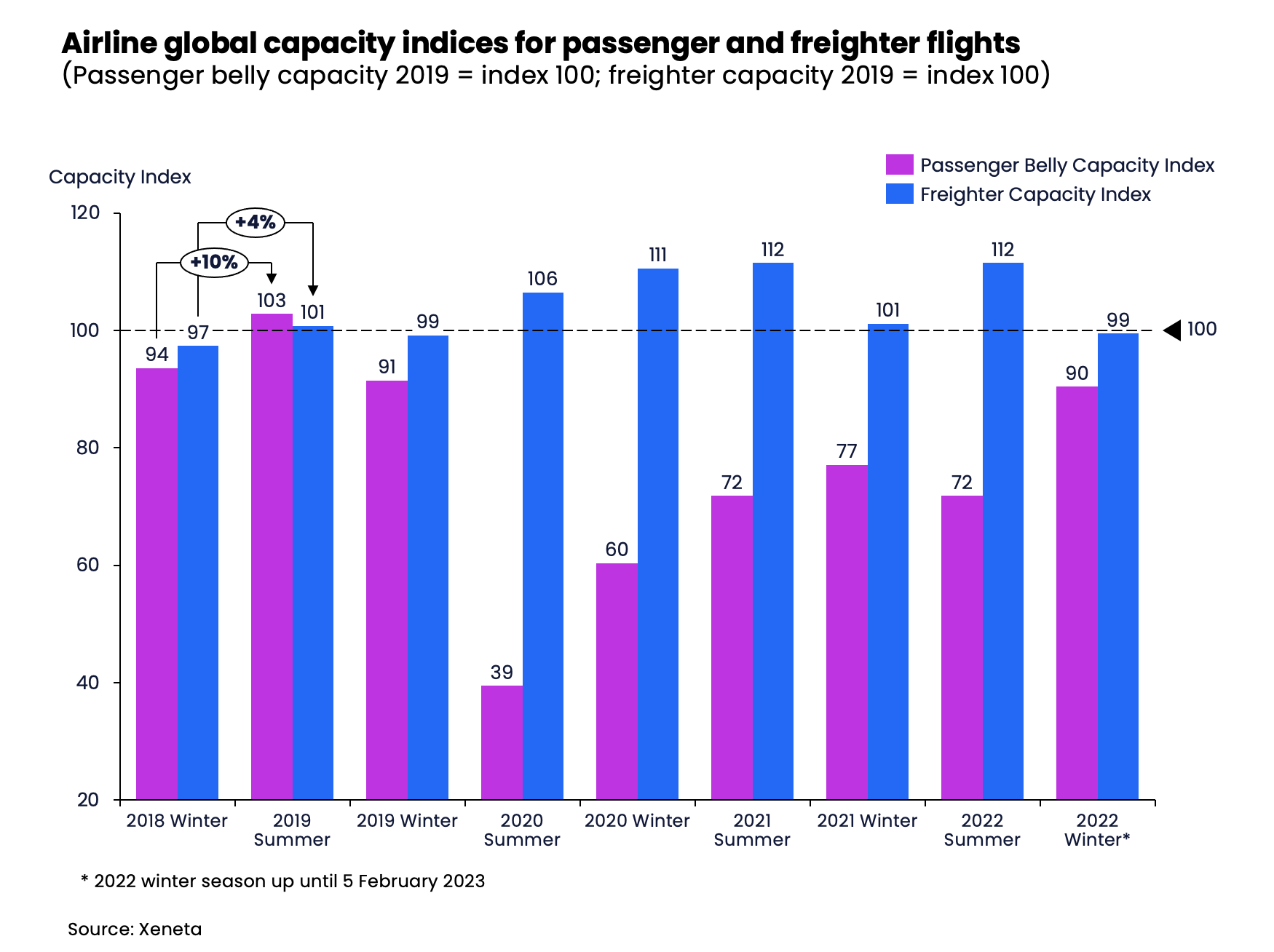

2019 summer season, from the end of March to the end of October, saw the global air cargo capacity increase by 7.1% from its winter season, the end of November 2018 to the end of March 2019. The increases are more pronounced for passenger flights as, unlike freighter capacity, passenger belly capacity is heavily influenced by passenger demand.

2019 summer season, from the end of March to the end of October, saw the global air cargo capacity increase by 7.1% from its winter season, the end of November 2018 to the end of March 2019. The increases are more pronounced for passenger flights as, unlike freighter capacity, passenger belly capacity is heavily influenced by passenger demand.

In the 2019 summer season, belly capacity from passenger flights went up 10% from the previous winter and then down 11% in the following winter. But the capacity from freighter flights remained relatively stable: it was up 4% in the 2019 summer season, then down only 2% in the winter.

The capacity adjustment, driven by higher passenger demand, from the end of March often coincides with lower air cargo demand during the slack summer period. In April 2019, the global air cargo load factor fell a noticeable four percentage points month over month.

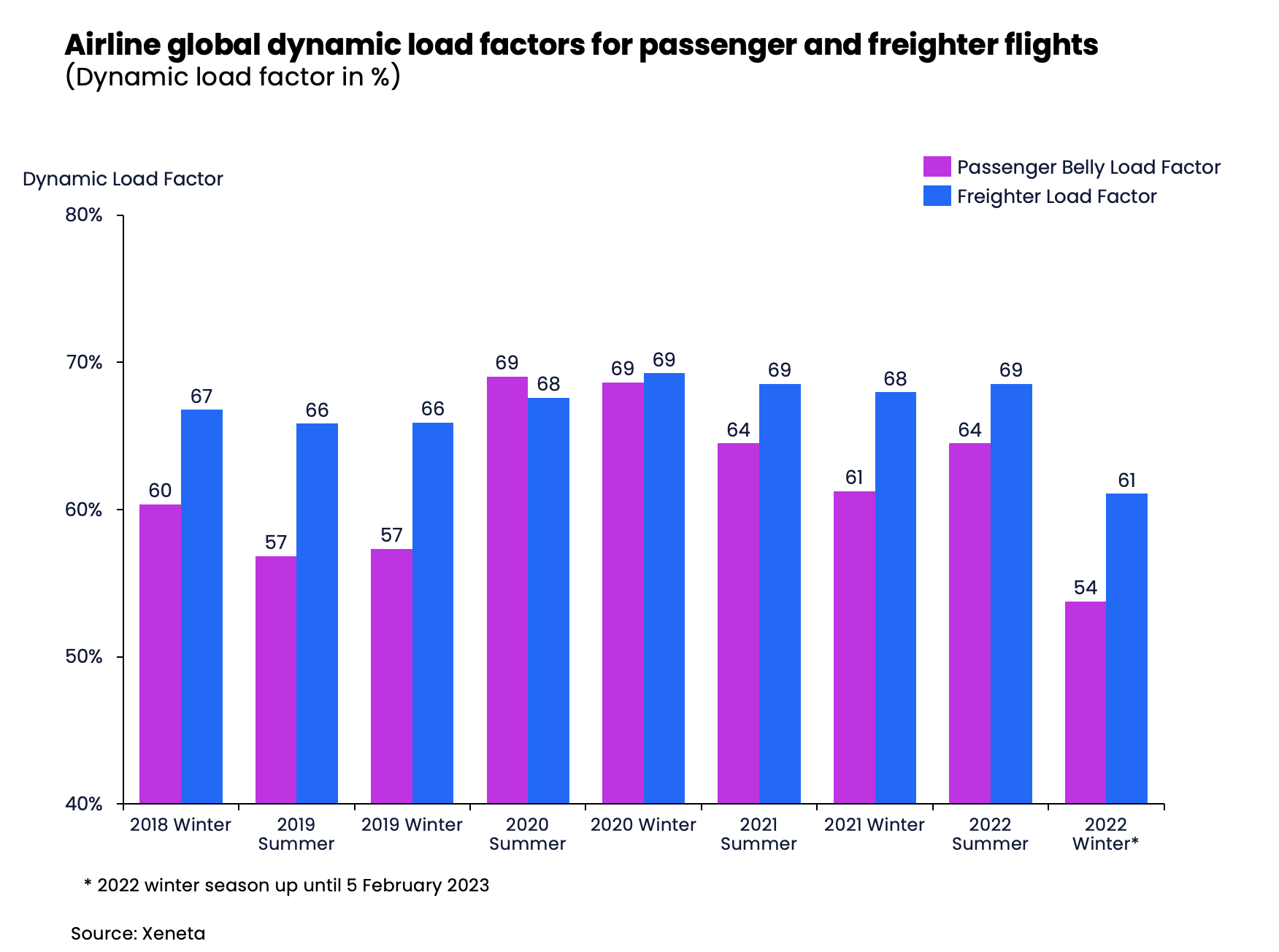

The capacity utilization for passenger flights tends to be lower than for freighters. Unlike freighters, passenger flights also operate on routes with much lower cargo demand, which results in a lower load factor, and they do not focus on maximizing cargo load the same way freighters do.

The capacity utilization for passenger flights tends to be lower than for freighters. Unlike freighters, passenger flights also operate on routes with much lower cargo demand, which results in a lower load factor, and they do not focus on maximizing cargo load the same way freighters do.

In 2019's summer season, the passenger flight load factor was, on average, 57%, while the load factor for freighters was 66%, nine percentage points above the load factor for passenger flights.

But the pandemic changed the picture completely. Both passenger and freighter flights reached high load factors (around 69%), with the spread between the two narrowed to around one percentage point in 2020.

It is worth noting that the fronthaul load factors went above the 90% threshold, which was much higher than the global average of 69%. Looking at this year's winter season, the spread between passenger and freighter planes' load factors returned to 7% between the end of October 2022 and early February this year, in line with the pre-pandemic range between 6% and 9%.

Due to economic headwinds and recovery of passenger numbers, load factors for both types of flights saw unusual falls in the 2022 winter season, which in normal years should be the other way around. Load factor for passenger flights fell to 54%, down a substantial 11 percentage points from 64% in the summer season of 2022. The load factor for freighter flights was 61% in this winter season so far, down seven percentage points from 69% in the 2022 summer season.

This hints at an even gloomier picture as the calendar flips over to April. With more cargo capacity coinciding with the seasonal low cargo volume, the upcoming new contract negotiations are likely to be fierce. This will especially be the case for airlines with a large share of freighters in their fleet, as cargo revenue is their main revenue stream.

It will also be interesting to see the volume share for the spot market, as the share has been propped up to around 45% for the past three years, up by 12 percentage points from the pre-pandemic 2019 levels.

Want to Learn More?

Watch the latest episode of our monthly State of the Market Webinar for air freight rates to see where you stand in the volatile markets. If you have any questions, please send them to info@xeneta.com.

PS: Missed the LIVE session? Sign up to get the full webinar recording.

.png)