The Transatlantic air cargo corridor has had a weak start to the year, which is in stark contrast to the global market.

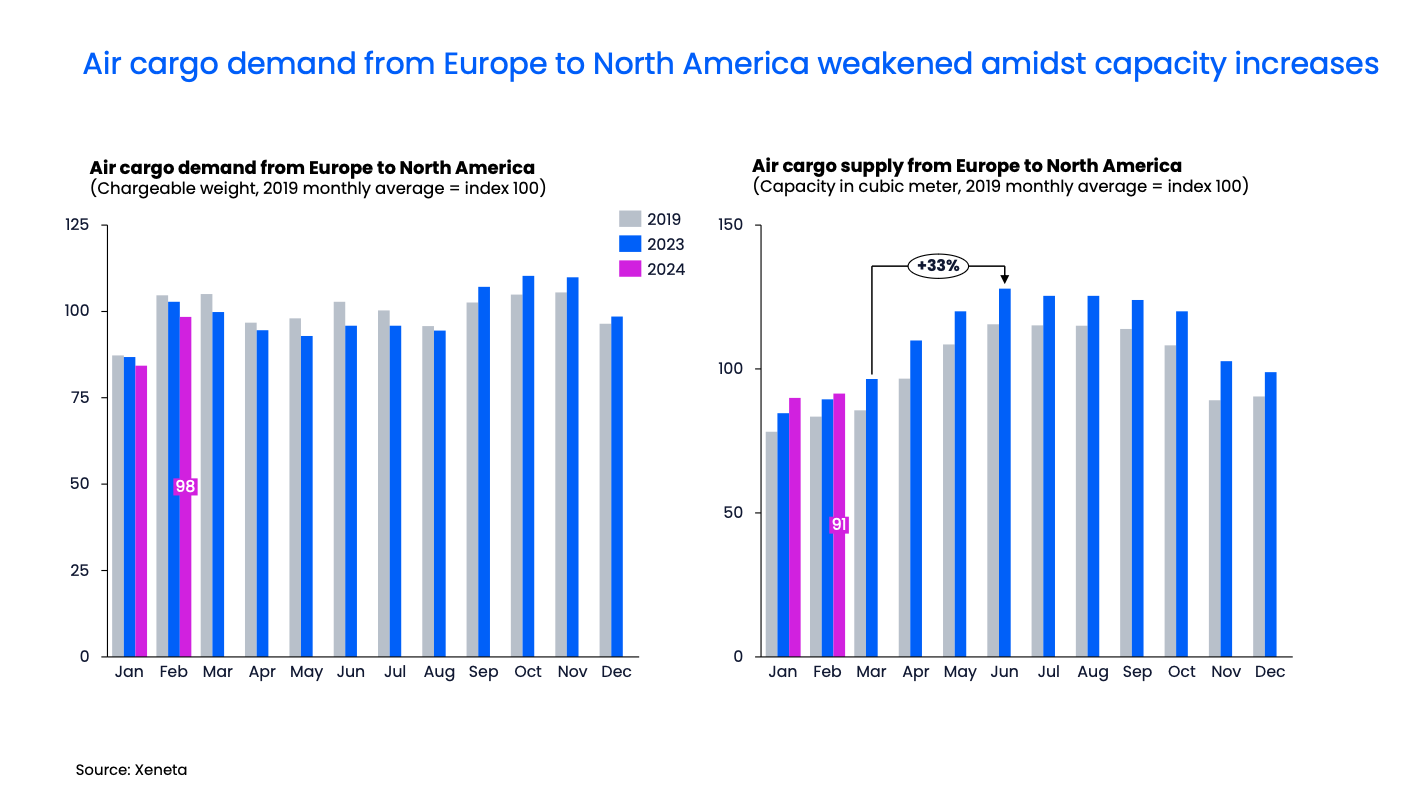

This is one of the world’s top three air cargo corridors, but in the first two months of this year demand from Europe to North America was down by 4% compared to the same period in 2023 and 5% lower than 2019 levels.

Interestingly, this trend has also been seen within ocean freight shipping on the Transatlantic trade, which saw a 4% year-on-year decline in demand in January.

A different story at a global level

The global air cargo market paints a different picture, with double-digit year-on-year growth (+11%) in the first two months of 2024 and +3% compared to the same period in 2019. This has been driven by factors such as disruptions in the Red Sea and strong demand for e-commerce out of China.

The decline in demand growth on the Transatlantic westbound corridor in 2024 is also a reversal of the trend seen in the final four months of 2023, which saw a 4% increase compared to the same period in 2019. The Transatlantic westbound also outperformed the growth in global demand during this period, which was down by -6%.

Supply-demand imbalance puts downward pressure on rates

In terms of cargo carrying capacity onboard aircraft, the Transatlantic market supply had already surpassed its pre-pandemic levels in 2023 and has continued to grow in 2024.

In the first two months of this year capacity has increased by 4% compared to the same period in 2023 and 12% above the level in 2019.

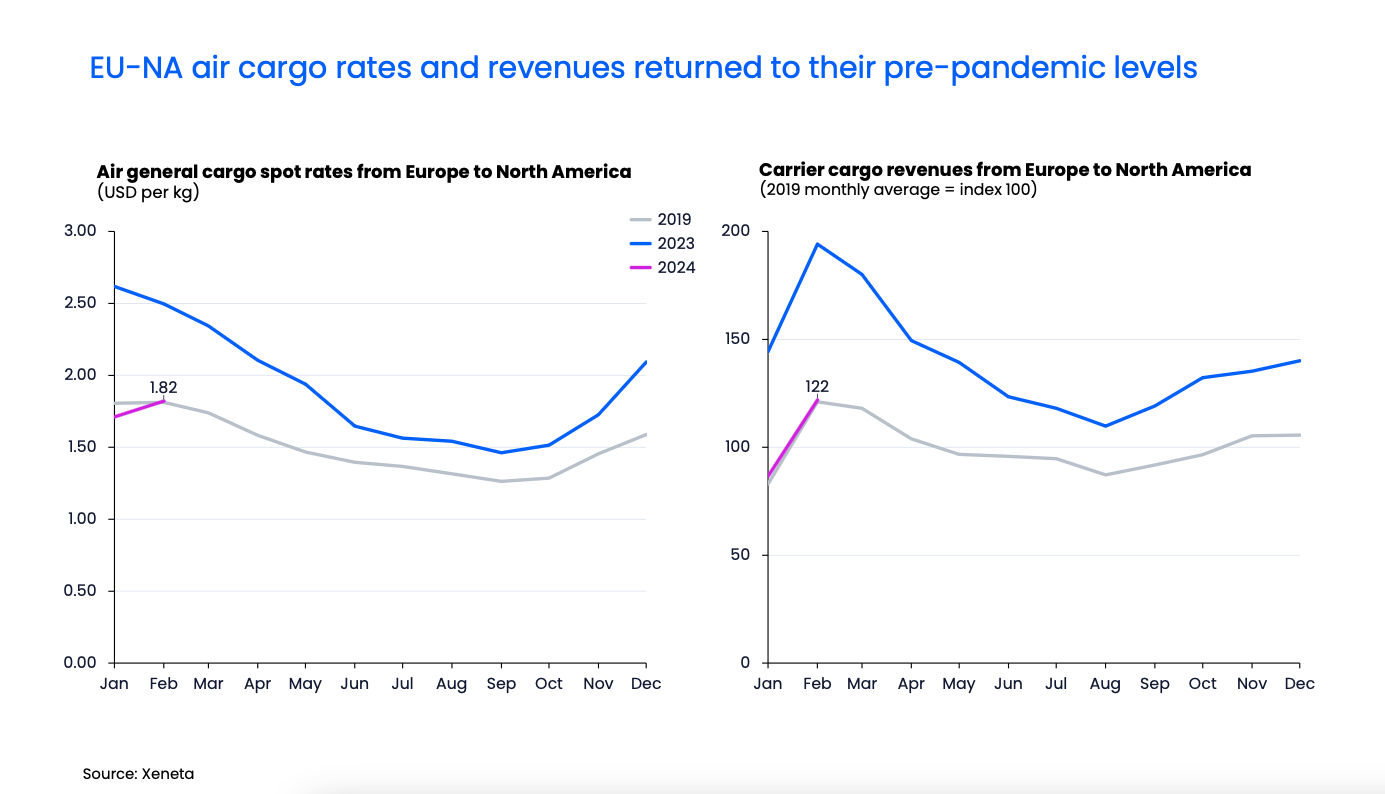

Thanks to increasing supply and decreasing demand, the average general cargo spot rate on this corridor fell by a sharp 27% year-on-year in February, ending at USD 1.82 per kg.

There has also been turbulence in the spot rate market after it fell below its 2019 level in January for the first time since the onset of the pandemic. This was only temporary however, with the spot rate returning to its 2019 level during February.

Summer schedules will drive cargo revenue down

Looking ahead, the Europe to North America market will inevitably face downward pressure on spot rates when airlines begin summer schedules on 31 March.

Last year, increasing demand for passenger travel during the summer months saw air cargo capacity increase by 33% from March to its peak in June.

This exposure to seasonal changes in passenger belly capacity is likely why freight forwarders continue to allocate a significant proportion of cargo volumes on the spot market.

By the week ending 10 March, the share of volumes shipped under spot rates was 46%, which is a 15-percentage point increase from the same period in 2019. Freight forwarders will expect the upcoming influx of capacity to follow historical trends and drive rates down.

With rates continuing to face downward pressure it is likely carriers will see cargo-only revenues on the Transatlantic fall to their pre-pandemic levels. In just the first two months of 2024 air cargo revenues have reduced by 38% to sit at the same level as 2019.

The recent developments on the Transatlantic underline the importance of using the Xeneta platform to analyse and benchmark air freight data at a global, regional and trade-by-trade level - because they don't all behave in the same way.

Xeneta will bring you further updates on the Transatlantic during 2024 as the summer schedules take off.

.png)