It's that time of year again when many companies, are entering the ocean freight rate negotiation season. With the current market dynamics, changing global trade policies and the never-ending effects of COVID-19, supply chains are in flux and suppliers have the upper hand. Hence it's even more important now that you have the factual data and information you need to enter into supplier negotiations.

We have put together a small survival guide with useful tips and questions to ask yourself that will make sure you bring your A-game to the table when negotiating with your suppliers. See those at the end of this article.

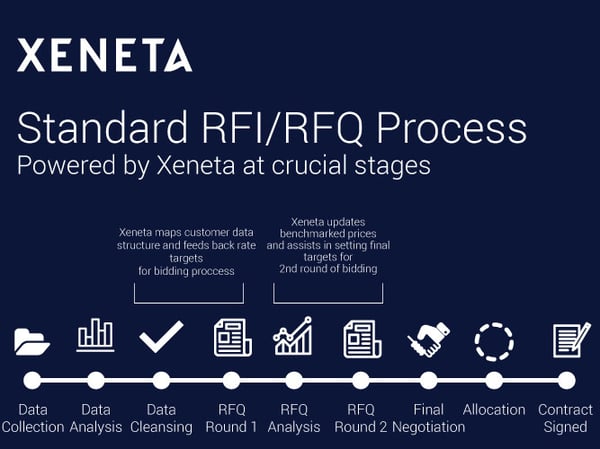

Requesting ocean freight rate bids can sometimes be a guessing game, which makes the process tedious for many. It's also time consuming and while it's something that supply chain, logistics and/or ocean freight responsible must do every year or so, it's best to be equipped with the necessary data to ensure a successful process.

Questions to Ask Yourself

-

How do I justify a potential increase in ocean transportation costs?

-

How do my rates compare against the market ocean freight rates and my peers?

-

Am I doing good job negotiating with my supplier or where can I improve?

-

How can I show my superiors I have done or can do an even better job securing competitive contract rates?

-

Is this supplier the right one for me?

-

Should I consider changing supplier for all or some shipping routes?

- What's the best length of contract for certain routes?

- Where and from which supplier can I get a competitive rate based on how the market has moved and will move?

Things to Keep in Mind

- Assure yourself that your negotiated rates with your supplier are comparable to the current market movements and are competitive.

- Benchmarking is the only way you can be at ease that you have gotten the best possible rate for your ocean freight and optimized your supply chain strategy.

- You want to come to the negotiation table with current market data that you can access immediately. Static and dated rate reports are not useful enough. You need the latest information.

- Keeping an eye on the ocean container market doesn't end at the negotiation period. You need to stay on top of the market all year along as it changes so quickly and you may want to go back and renegotiate, if your terms allow.

Make informed decisions with actionable freight rate data.

Save time and mitigate risks during this sea container rates bidding and negotiation season with Xeneta.

Get Your Free Freight Spend Analysis

As you prepare for your RFQ, knowing how the ocean freight market prices are moving is imperative to help you negotiate better with your shipping suppliers. But access to reliable and real-time data to benchmark your container prices for the spot and long-term ocean freight market is a challenge.

We'll show you how the Xeneta platform's 280+MN rates on 160K port-port pairs can help you get full visibility into all your ocean freight spend.

Give us a sample of your data and we'll help you identify your savings potential and trade lane optimization. Experience the potential for yourself with our freight spend and business case analysis.

.png)

-1.jpg)