Happy 2020! The results of our IMO 2020 Survey we ran a few of weeks ago via our social media channels are received and tabulated. Thanks to all in the shipping community who took the time to answer the questions. You will find the results below in a nice infographic for easy consumption. Feel free to share with your colleagues and peers.

We had respondents from all segments of the industry, from carrier senior-level management to multiple levels of management in the forwarder and shipper segment. As a reminder, we defined ‘Carrier;’ as vessel or fleet owner/lessor, etc. and by Shipper we meant traders, BCO’s, NVOCC’s, exporters-importers, agents, and similar.

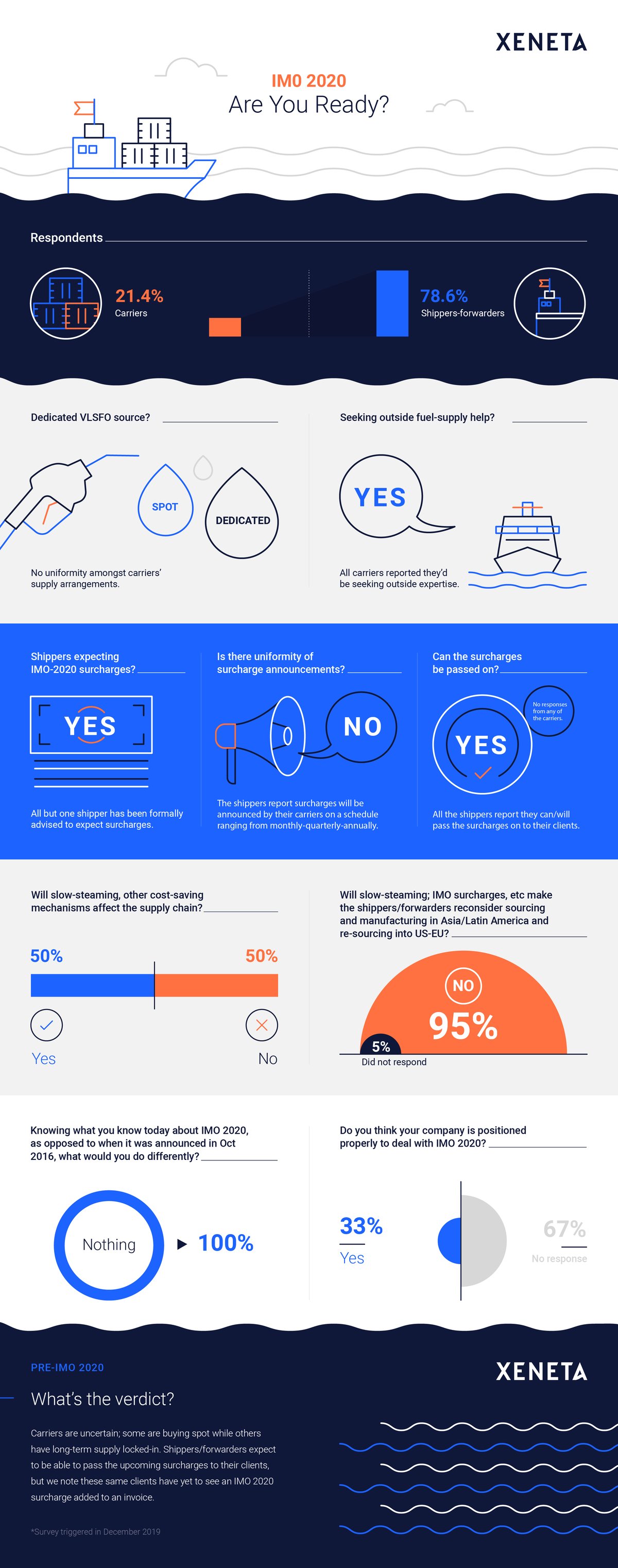

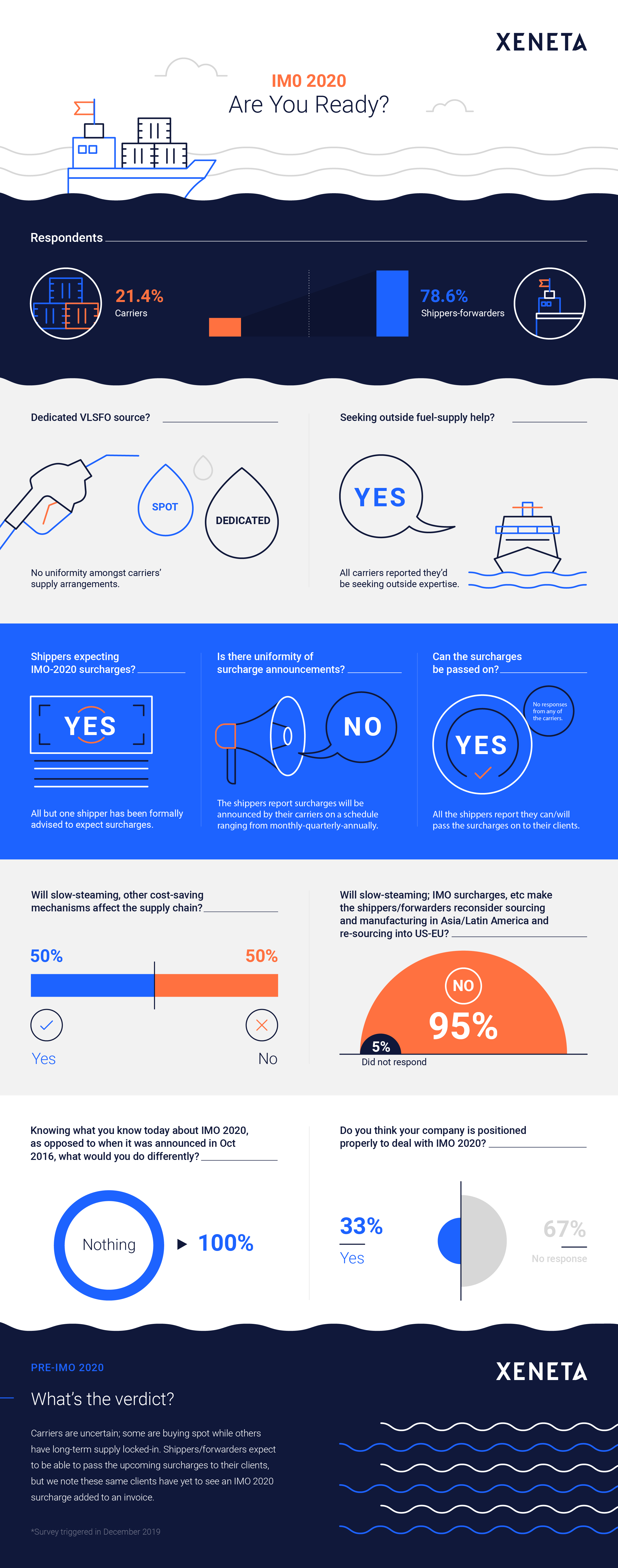

The demographics roughly mirrored the box ship industry, which has more shippers/forwarders than carriers. 21.4% of our respondents were carriers, with 78.6% shippers-forwarders.

With 2020 in swing, what do we know?

Carriers are uncertain; some are buying spot while others have long-term supply locked-in. Shippers/forwarders expect to be able to pass the upcoming surcharges to their clients, but we note these same clients have yet to see an IMO 2020 surcharge added to an invoice. No carrier responded to our Scrubber vs-VLSO-vs LNG question.

Equally interesting is that that 1/3 of our respondents think they’re correctly positioned to deal with IMO 2020, and that none of the expected IMO 2020 costs make any of our respondents want to abandon international trade and ‘re-shore’ their manufacturing/sourcing. That's positive.

The net-net is that neither the carriers nor shippers/forwarders know the effects IMO 2020 will have on their business models.

Your thoughts?

.png)

-1.jpg)