Even more than ocean freight, air freight has been at the mercy of near-term developments throughout the pandemic. Identifying these market disruptions and keeping in close contact with carriers and freight forwarders is essential for air freight shippers to succeed.

Watch our latest episode of 'State of the Market – Air Freight,' with Paul Mullins, CRO of Xeneta, and Niall van de Wouw, Xeneta's Chief Airfreight Officer, to learn about recent air freight rate developments and get actionable insight to stay on top of potential future disruptions.

In this webinar, we addressed the shift in market appetite as we see 12-month contracts now replacing the three- and six-month contracts. However, these long-term contracts come with a volume cap, which means shippers are forced to go to market when they exceed the capacity allocation.

It does offer a little bit of stability, but if you are going back into the spot market within a month of procurement, the dynamic behavior will still be there. When it comes to procurement, the numbers indicate that the market is not as tight capacity-wise as it was a year ago.

Load factors are a few percentage points lower than last year. However, we see that external factors are continuing to make it very difficult to get the goods from point A to B by air and therefore, the race is still on. There's still a low level of uncertainty, as a major airline recently announced they couldn't complete any transhipments due to staff shortage.

We do not see a dramatic shift in the underlying issues compared to Q4 2021, but the whole market is currently very fragile. Apart from flight cancellations and ground handling labor shortages issues, increased passenger confidence has also strained trade lanes.

It's a mess on a global level.

Top Market Trends in Main Corridors

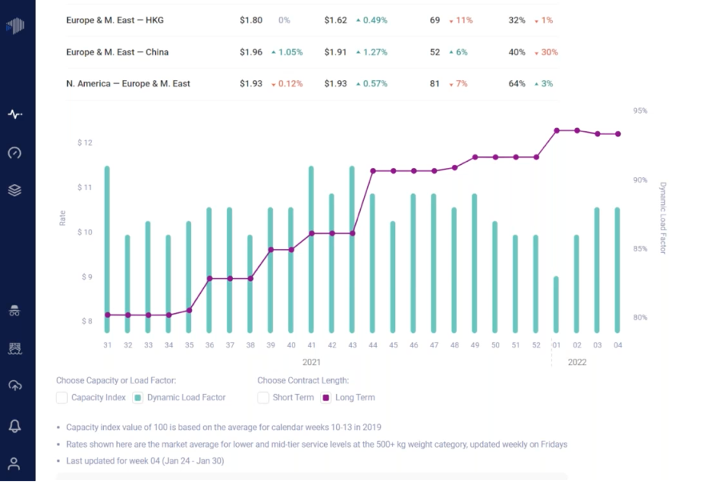

Xeneta platform shows a spike in long-term rates above three months and the dynamic load factor in weeks 43-44 from the Asia Pacific into the EU.

Xeneta platform shows a spike in long-term rates above three months and the dynamic load factor in weeks 43-44 from the Asia Pacific into the EU.

Along with the Lunar New Year effects and pilot shortages, we see the typical decline in load factor until Christmas and then picking up again at Lunar New Year. The spike at week 43 can be related to the rates that shippers and forwarders usually negotiate around the change of the seasons.

While some Asian flag carriers are ordering additional aircraft for their fleet, this will not impact capacity right now. The most significant potential for idle capacity remains as passenger planes that are flying much fewer hours.

On the Europe North America Lane, Xeneta shows a dip in the dynamic load factor - down to the mid-60s in week one and jumping back up again. The angular look at the axes on the left-hand side shows the capacity, with load factor on the right.

On the Europe North America Lane, Xeneta shows a dip in the dynamic load factor - down to the mid-60s in week one and jumping back up again. The angular look at the axes on the left-hand side shows the capacity, with load factor on the right.

While we previously thought capacity would increase when the US opened up to travel, Omicron has stunted that, as most are still not traveling internationally.

The drop in load factors is typical before Christmas, but now it is close to 80% again. This is a small reflection on the overall trade labor, as airlines are looking after their core business and opening up for their existing customers. Still, the integrated volume hasn't had a massive impact on the trade lane.

With Europe to North America being a headhaul lane, we tend to see a premium for short-term rates on the front hall and a premium for long-term rates on the backhaul. We currently see about a 20% higher premium on this lane than the longer rates.

This is comparatively different between the Asia Pacific and North America, which is also a front haul lane, but the short-term rates are roughly 20% higher than the long-term rates. This gap is interesting to watch because it indicates the tension in the recent market. If the gap continues to widen, that suggests there's more short-term pressure than long-term.

Meet The Speakers:

Paul Mullins, Chief Revenue Officer, Xeneta

Niall Van De Wouw, Chief Airfreight Officer, Xeneta

Want to learn more?

Sign up today for our upcoming monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

PS: Missed the LIVE session? Sign up to get the full webinar recording.

.png)