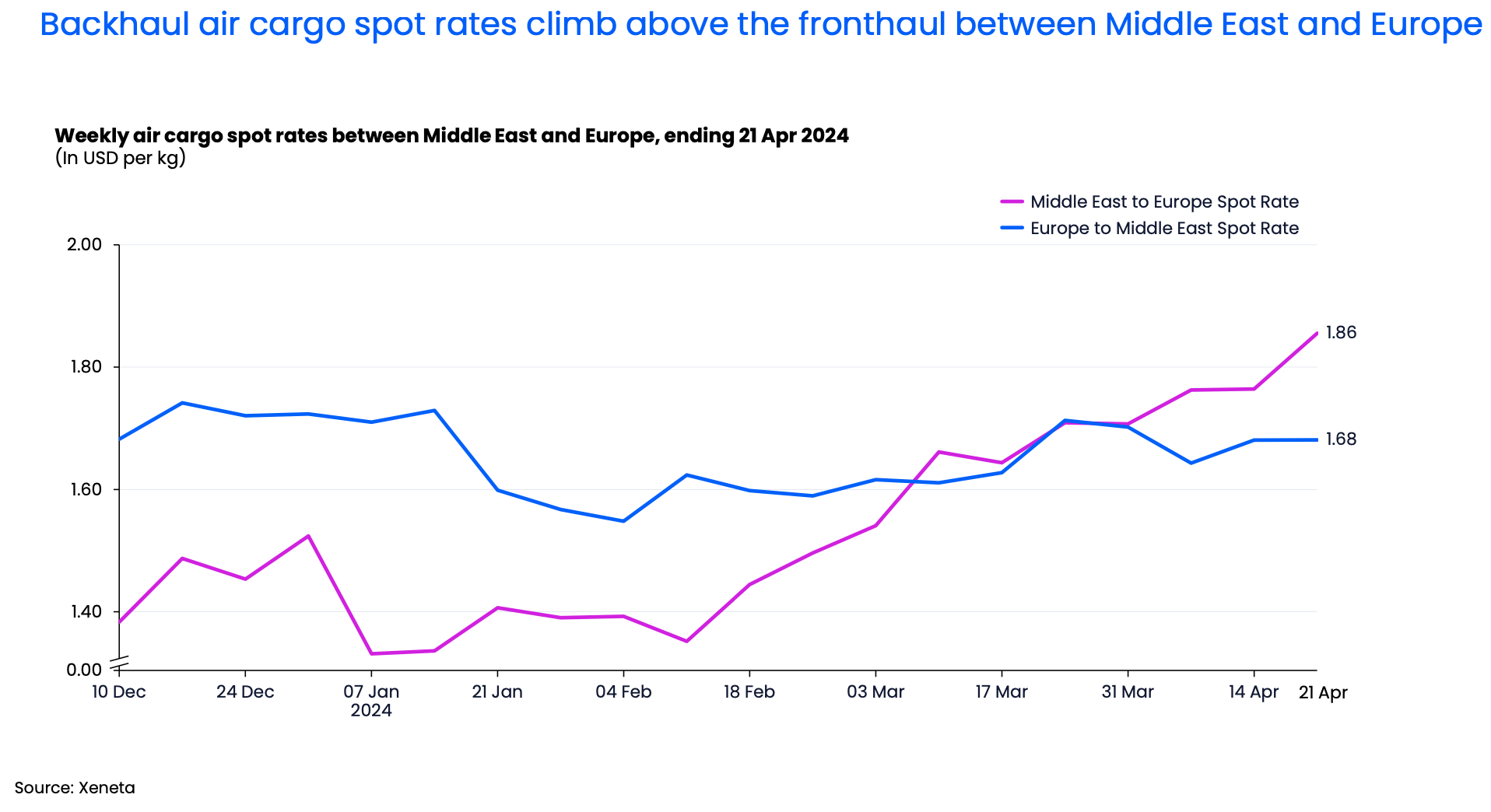

There has been a reversal of traditions across fronthaul and backhaul air freight corridors between Middle East and Europe since the start of the year.

This has been driven by significant developments on the Middle East to Europe air cargo trade – usually considered to be a backhaul route.

In the week ending 21 April, the average spot rate on this trade hit USD 1.86 per kg. This is a 39% increase since a market low at the beginning of 2024 and the highest rates have been since early April 2023.

Geopolitical tensions are driving backhaul rates up

A series of geopolitical events have been pushing air cargo spot rates up on the Middle East to Europe backhaul trade.

Disruption to ocean supply chains following the escalation of conflict in the Red Sea region last December has seen shippers switch to air freight in order to meet strict delivery timelines, with urgent shipments out of Northeast, Southeast and South Asia transiting via hubs in Middle East.

Shippers have also switched to a hybrid sea-air supply chain. Goods being exported from Asia arrive in the Arabian Gulf via ocean at ports including Jebel Ali before being flown out of Dubai Airport for onward transportation to Europe.

The recent escalation of conflicts in the Middle East between Iran and Israel has also impacted the air freight market. This includes the seizure of the MSC Aries container ship by Iranian forces near the Strait of Hormuz (a vital waterway for sea-air services) and drone attacks against Israel which caused airspace closures across the region.

The above events – as well as last week’s heavy rainfall which brought disruption at Dubai Airport – have contributed to a narrowing in the gap between the average spot rate (valid up to one month) and seasonal rate (valid for more than one month) from the Middle East to Europe.

At the start of 2024 the spot rate was 42 cents below the seasonal rate, but by the week ending 21 April it was just 15 cents adrift.

Europe to Middle East fronthaul remains more stable

In contrast to the dramatic developments on the backhaul, the fronthaul trade from Europe to Middle East has been relatively stable.

The average spot rate on the fronthaul was USD 1.68 per kg in the week ending 21 April, which represents a slight dip of 2% since the start of the year. It is also below the level in the same period in 2023.

The eastbound fronthaul is less impacted by the shift to sea-air services due to the Red Sea conflict so the spot rate has continued to stay below the seasonal rate, maintaining an average gap of 36 cents since the start of the year.

This has culminated in a reversal of traditions, with backhaul air cargo spot rates exceeding those on the fronthaul since early March – and the gap was continuing to widen in the week ending 21 April.

Magnitude of trade imbalance remains

While the market has seen a reversal of traditions in terms of rates, there remains a significant gap between the fronthaul and backhaul in terms of volumes.

Air cargo volumes on westbound routes are about one third of the level transported on eastbound trades. Only in the final week of March did volumes from Middle East to Europe briefly reach 50% of the level seen on the fronthaul from Europe to Middle East, before quickly falling back to 28% in the week ending 21 April.

Back-up plans in event of further escalation of conflict in Middle East

The westbound air cargo spot rate increase reflects market concerns over the geopolitical risk to supply chains in the Middle East region. So, what next?

It is difficult to predict the trajectory of such a volatile geopolitical situation with certainty, but any potential escalation in the Israel-Iran conflict could compromise the Strait of Hormuz, which is a crucial corridor for crude oil supply and container shipping, as well as cause airspace closures and flight re-routing across the Middle East.

This scenario would raise significant concerns for shippers, particularly those who are using sea-air services via Dubai Airport due to conflict in the Red Sea region.

If Plan A (the Red Sea and Suez Canal) and Plan B (sea-air services via Dubai) are no longer viable options to transport cargo from Asia to Europe then shippers will need a Plan C. This may come in the form of sea-air transits via Singapore and South Korea for cargo heading westbound out of Asia and via Los Angeles or Vancouver for cargo heading eastbound.

The cost of shipping from Asia to Singapore via ocean and then on to Europe via air appears to be a viable option. Both ocean freight container rates from Northeast Asia to Singapore and air freight rates from Singapore to Europe have remained relatively insulated from the market volatility caused by the Red Sea crisis and the Israel-Iran conflict.

Crude oil prices suggest no immediate escalation to the region

However, if shippers want cause for optimism that a Plan C will not be required, there appears to be an easing in the immediate risk of a serious escalation in conflicts between Iran and Israel. This is reflected in Brent crude oil prices remaining below USD 90 per barrel since 19 April.

If a de-escalation of risk does occur in Middle East then it is likely a softening of air cargo spot rates will follow. Closely monitoring regional air cargo demand trends with the Xeneta Air Advanced platform may offer insights into the direction of air freight rates in a volatile market - and help businesses be better prepared for the upcoming year-end peak season.

.png)

.avif)