Spot rates are on the rise on China to Europe Fronthaul

General air cargo spot rates from China to Europe took off towards the end of November, but the industry should not get carried away just yet...

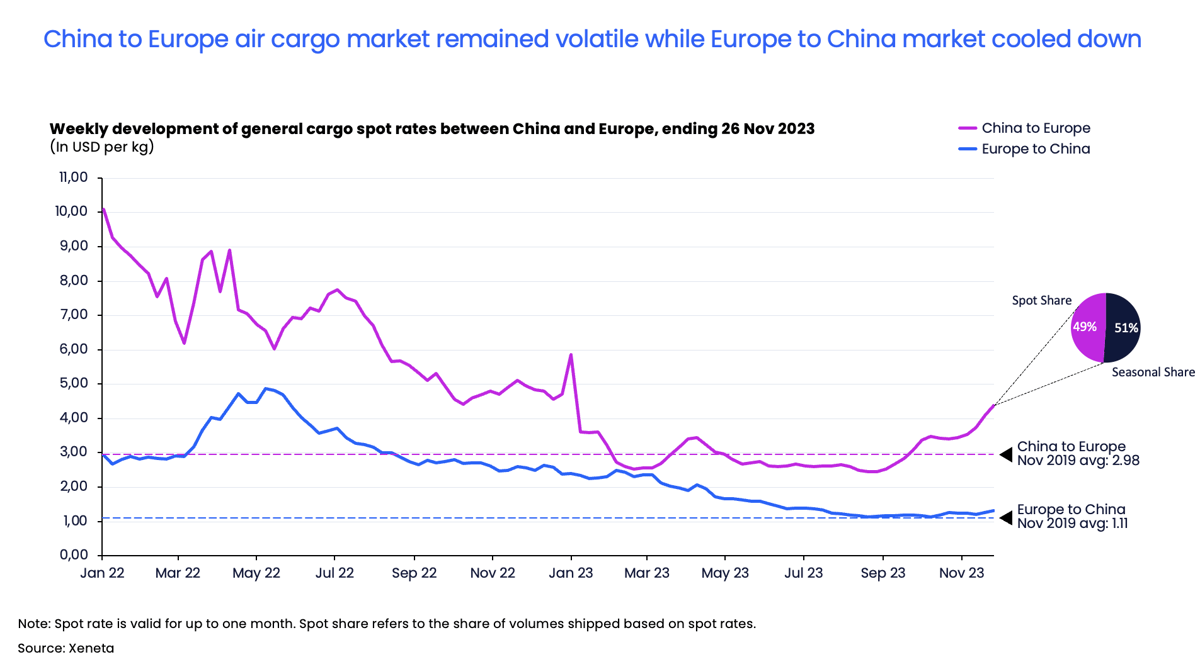

In the week ending 26 November, the general air cargo spot rate on this fronthaul trade stood at USD 4.37 per kg, up by 27% compared the same period a month ago.

This increase is in stark contrast to November 2022 when the seasonal spot rate uptick was short-lived and muted due to weakened consumer demand.

If spot rates on this fronthaul are back on the up, does that mean consumer spending is also on the rise?

Not quite.

In fact, amid ongoing inflation and high interest rates, the EU Consumer Confidence indicator continued to register a negative reading of -16.9 percentage points in November.

How can increasing spot rates at a time of negative consumer confidence be explained?

The answer lies in inventory levels, which had piled up in 2022 due to weak consumer spending. Since that point, businesses have been working hard to correct these bloated stock levels, meaning there was less requirement for shipping in new goods.

Since Q3 last year, the pace of inventory build-up has slowed down (source: European Central Bank), and businesses are now ready to bring in new stock in more regular cycles.

The current uptick in air cargo demand and rising rates should be seen as a product of delayed ordering. Businesses did not have the required levels of stock in place for the year-end holiday season, resulting in a sudden demand from the e-commerce sector which pushed rates up higher.

It should also be noted that the general cargo spot rate on the China to Europe fronthaul is still far above its pre-pandemic levels. In November, spot rates were 32% above the 2019 average, standing at USD 2.98 per kg.

Spot rates have remained at this level due to the constraints in belly capacity which still exist. Other factors include re-routing around Russian airspace, which absorbs capacity through longer flight times.

Even more significantly is, despite China’s lifting of Covid restrictions earlier this year, the number of weekly flights to and from the region remain significantly below pre-pandemic levels. This is especially the case on long-haul routes such as the corridor to Europe.

It is not surprising that the share of volumes shipped on spot rates contracts still accounted for 49% of the total market for China to Europe corridor, which is 19 percentage points higher than the average 2019 level. Freight forwarders and carriers have yet to restart fixing longer-term contracts, which they have been holding back due to market uncertainties for the next year.

Backhaul: Europe to China

Due to the Europe to China corridor being a backhaul trade, overcapacity is significant when viewed in the context of the much lower volumes being shipped. This is reflected in a cargo load factor of only 49% in late November, which simply put, means planes were flying half empty.

In freight rate terms, this translates into a general cargo spot rate from Europe to China of USD 1.31 per kg in the week ending 26 November. This is 70% lower than the fronthaul spot rate in the same period.

Due to the ample space available on the backhaul, the year-end cargo ‘peak’ season did not trigger the same level of rate uptick as observed on the China to Europe fronthaul market. In the same timeframe, Europe to China general cargo spot rate only ticked up a marginal 5% from a month ago.

Due to weak demand, the seasonal rate kept sliding downwards to close its gap with the spot rate.

In comparison to still-elevated fronthaul rates, the Europe to China general cargo spot rate in November was only 13% above the level in the same period in 2019.

Looking ahead – freight forwarders may resist longer-term contracts

As we head into 2024, there are many uncertainties for the China to Europe air cargo market. And the share of cargo volumes handled in the spot market will likely remain high at least in the first half of 2024.

With expectations of still-subdued consumer demand, freight forwarders will likely be unwilling to fix longer-term rates with carriers at current ‘above-pre-pandemic’ levels on the China to Europe corridor.

Uncertainties in belly capacity, which will likely continue to recover next year, will also impact the market. Civil Aviation Administration of China expects international passenger flights to be at 70.7% of 2019 levels in the winter season ending March 2024, up from the October level of 51%.

China has announced a visa exception for citizens from Germany, France, Italy, Spain, the Netherlands and Malaysia. In place until 30 November 2024, this exemption has been introduced to boost tourism and will allow people from these countries, which make up two-thirds of EU GDP and population, to enter China for up to 15 days without a visa.

This increase in passenger demand may fuel the recovery in belly capacity between China and Europe.

In the upcoming year there are still many variables in play which will influence the pace of recalibration between supply and demand in the China-Europe air cargo market.

It is crucial to keep a close watch on the restoration of cargo belly capacity and cargo load factor on this trade.

Want to learn more?

Contact us to learn how Xeneta can help you prepare for this upcoming tender season and supplier/buyer negotiations. Gain the upper hand with actionable real-time ocean and air freight rate and capacity data.

.png)