The fronthaul and backhaul air freight markets between China and Europe could hardly be more contrasting at present as both shippers and service providers react to an unusual beginning to 2024.

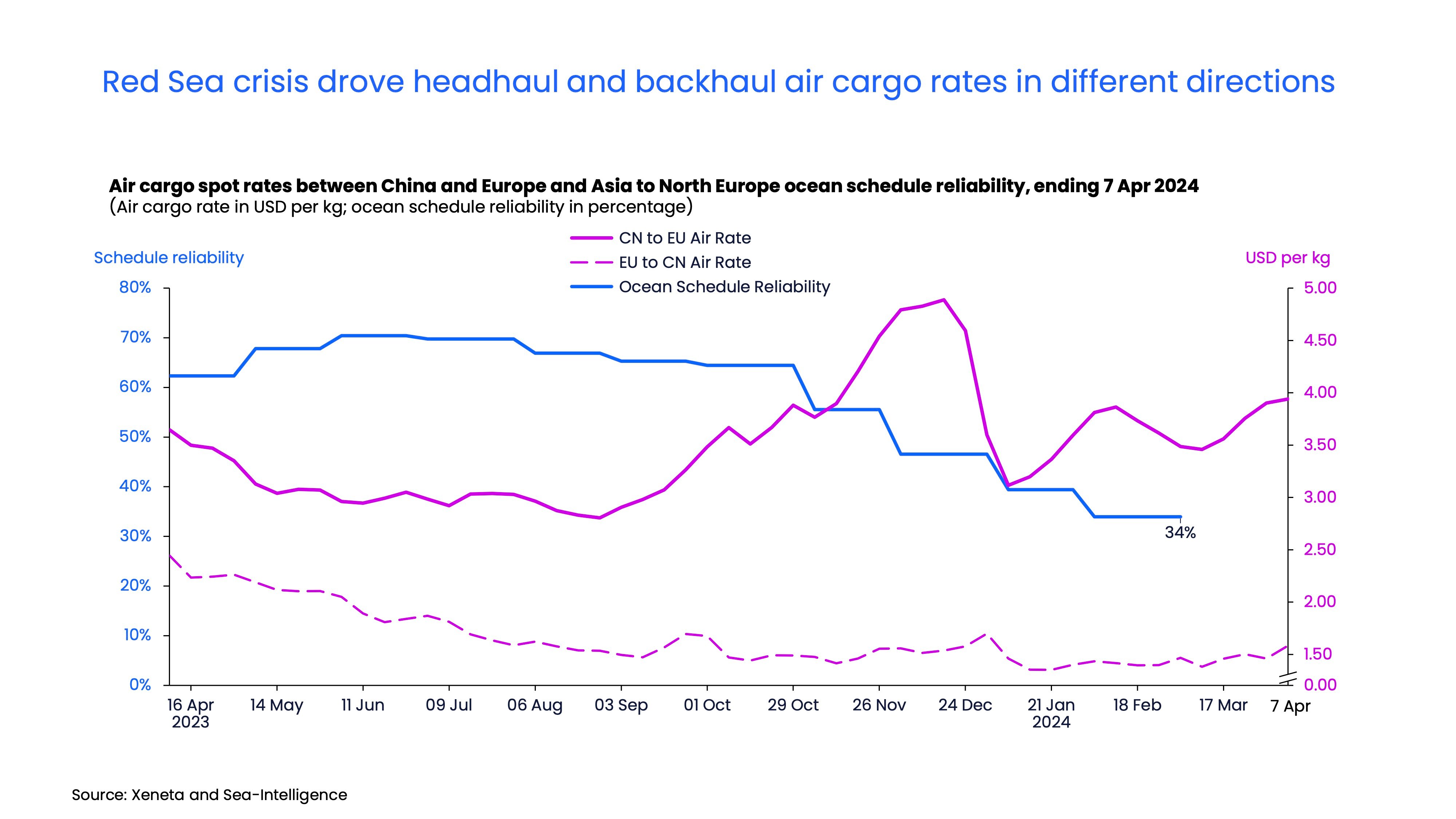

On the fronthaul market, the average air cargo spot rate from China to Europe in the first week of April hit USD 3.94 per kg. This is the highest it has been so far in 2024 and 76% above its pre-pandemic level in 2019.

It is an unusual situation given this time of year is a traditionally slack period for the air cargo market following the year-end holiday season.

While the fronthaul market has heated up, the opposite is true on the backhaul from Europe to China with rates remaining relatively flat. In the first week of April, rates hit USD 1.59 per kg, which is just 5% above the level in 2019.

Red Sea conflict sees shippers switch to air cargo

If we want to understand the main drivers behind rate increases on the fronthaul market, we should look towards the Red Sea and a conflict which has impacted reliability in ocean freight services.

The latest data shows schedule reliability for ocean container services from Asia to North Europe hit a low of 34% in February, a level last seen in August and September 2022 when the market was slowing down from Covid-19 related demand surges (source: Sea-Intelligence).

Falling reliability from Asia to Europe may not be surprising given this is an ocean freight trade heavily impacted by being unable to transit the Suez Canal due to the risk of missile attacks by Houthi militia in the region.

Alongside deteriorating schedule reliability, the cost of ocean freight container shipping from the Far East to Europe has been impacted by the situation in the Red Sea. By March, spot rates on this trade had increased by 115% from December last year before the escalation in conflict.

While ocean freight shipping rates are now softening as carriers adjust schedules to the longer sailing distances around the Cape of Good Hope, the market conditions of the past few months have prompted shippers to shift mode to air cargo for some of their goods.

Given the huge volumes involved in ocean freight shipping, it doesn’t take much of a percentage swing to have a considerable impact on the air freight market.

Fronthaul is a freight seller's market

The shift from ocean to air is evident in the market, especially for shippers utilizing the sea-air option.

For example, Dubai is a popular transit hub and outbound air cargo volumes to Europe in March were more than double the level seen a year earlier.

Increasing volumes also saw air cargo capacity utilization at its maximum. Dynamic load factor is Xeneta’s measurement of cargo capacity utilization based on both the volume and weight of cargo flown. On the fronthaul from China to Europe it hit 96% in early April, up 4 percentage points from a year ago and higher than its pre-pandemic level.

Increasing volumes and decreasing available capacity means the China to Europe air corridor is currently a freight seller’s market, with average spot rates remaining above average seasonal rates since January.

Other factors are at play

Conflict in the Red Sea is not the only factor placing upward pressure on air cargo rates from China to Europe. The three-day Qing Ming festival in China has been a contributory factor, as well as Ramadan which affects transshipment via the Middle East, and the Easter break which mainly impacts destinations in Europe.

The question now is where rates may be headed.

Both spot and seasonal rates reached their highest level in early April following a temporary decrease post the Lunar New Year cargo rush.

However, with Ramadan and Easter now over and the situation easing in ocean freight services, we are likely to see some downward pressure on the air cargo market.

The signs may already be there after the first week in April saw a slowing of growth in average air cargo spot rates from China to Europe, increasing by a modest 1% week-on-week and down from the 6% increase seen two weeks earlier.

Backhaul rates drop below pre-pandemic levels

Turning attention to the backhaul and the trade imbalances between Europe and China have resulted in increased available capacity.

In early April, the average dynamic load factor dropped as low as 46%, down from 57% in March. The dynamic load factor across March and April was approximately 13 percentage points lower than the pre-pandemic levels in the same period.

With cargo holds half empty, the air cargo spot rate from Europe to China fell by a drastic 35% year-on-year in the week ending 7 April.

This is after the average air cargo spot rate had already fallen below pre-pandemic levels by 5% in March to USD 1.45 per kg.

However, while these market conditions may be in sharp contrast to the fronthaul trade, they are not particularly unusual for major European outbound trades to Asia.

The current backhaul rates may also offer relief for some shippers, particularly those who ship temperature-controlled cargo, which is common on these Europe outbound routes.

How to navigate an unusual market

The diverging trend between the front and backhaul trades is certainly creating an interesting dynamic, but how can businesses approach such different and unusual market conditions?

Firstly, on the fronthaul, shippers must keep a watchful eye on rates, which the Xeneta platform can offer help with, and consider extending existing contracts. The summer months traditionally bring a cooling in the market so shippers may want to wait before locking into new contract rates.

It is a different story on the backhaul, which is beset with available capacity and subdued spot rates. Shippers may opt for a different strategy and strike now to lock into longer-term contracts.

Whether it is the fronthaul or the backhaul, the only way to navigate this dynamic air freight market is by utilizing and understanding the data. Only that way can businesses make evidence-based decisions on their supply chains.

This is also an important example of why Xeneta customers use the data and intelligence platform to monitor both the air and ocean markets – no matter what their primary transport mode is.

.png)

.avif)