During a plenary discussion at Xeneta Summit 2022 in November, the Vice President of Xeneta’s Customer Solutions Team, Michael Braun, reviewed the past ocean freight tender season and analyzed the strategies and impacts of various industries. While talking to shippers, Michael also covered what worked efficiently in 2022 and the best practices of their peers.

The general view for shippers looking back over the last three years may feel like we have been riding a rollercoaster with ups, downs, twists and turns. All of this can seriously upset the balance and mess with our perception as we try to plot a steady course into the new year.

Both large and smaller shippers are, to some extent, in the same boat, as both have experienced such turbulence, and both are adjusting. So, looking from the outside, where are we on the journey? Are we down, up or leveling off?

Everybody perceives things differently. It’s one market out there, but we are situated in different regions or at different points in the process as we approach the market with different concepts. There may be one general flow, but it’s not happening to everybody at the same time.

Covering all the bases

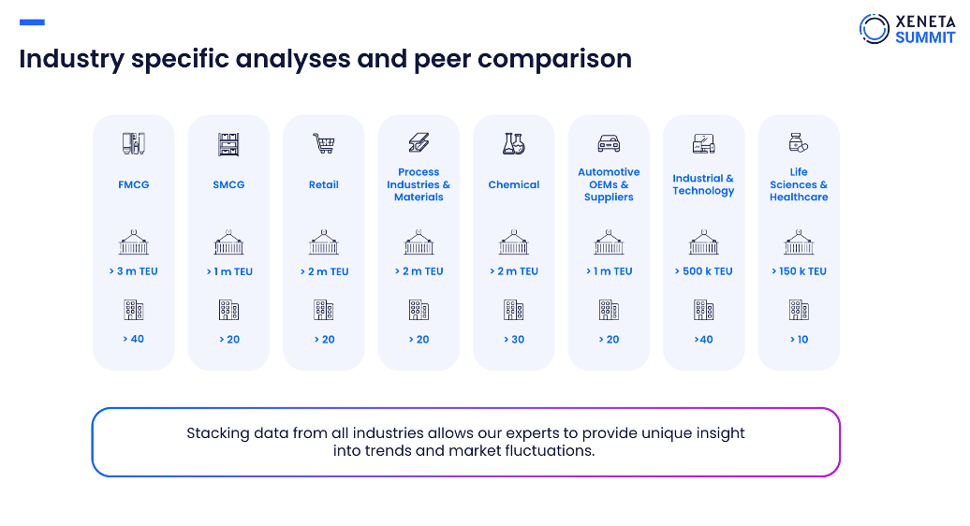

One of the things we do in the Xeneta Customer Solutions team is evaluating the performance of every player in the market. We can compare each shipper with their peers, as well as apply this evaluation to the carriers in the portfolio. We can also drill down into the customer-specific base.

Despite a myriad range of factors in play, the one thing we have learned over the last few years is we absolutely need to be prepared.

Covid-related lockdowns, blockages, congestion, geopolitical tensions, surges in demand and inflation, fuel costs, drops in demand and recession - These are just a few of the factors that mean we are moving away from ‘just in time’ to ‘just in case’ because nobody knows what is coming over the horizon.

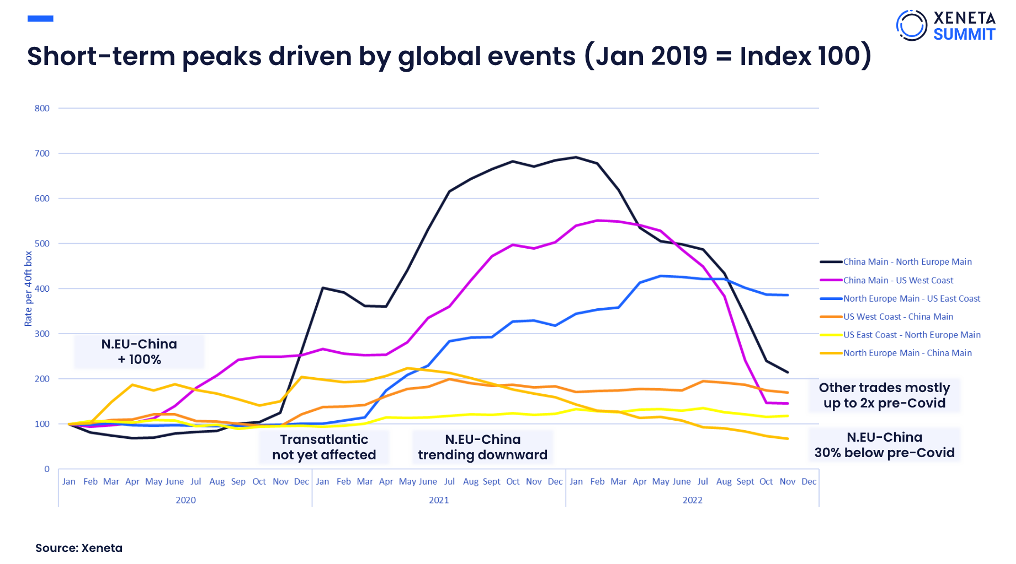

Of course, Covid-19 shook things to the core. When the lockdowns began, people could not consume anything. There were a lot of blank sailings in the early part of 2020 as the effects of the pandemic took hold.

At that time, the carriers took out a lot of capacities to avoid bankruptcy. Then came a surge, fuelled mostly by demand coming back in the US, and that led to a rise in rates - especially evident on the transpacific.

We saw impacts on all of the trades, and, for example, rates shot up for Asia to Europe to 12,000, 14,000 and 16,000. Some companies were even paying up to 30,000 on some trades.

Scarcity was the driver. It was like a big conference in a city where half of the hotels have burned down, people end up fighting for the few rooms available, and prices skyrocket.

At the time, shippers with long-term contracts could still live with at least the minimum quantities committed. But the spot market went into a kind of a ‘Wild West’ mentality. This not only affected the main trades but also knocked into the backhaul trades.

Why? Because the carriers calculated that rather than taking a box to Central Europe and making a terribly paid backhaul trade costing two weeks’ time, it was much better to stay empty and send a container back to Asia directly, fill it again and charge 10,000 dollars for it.

Did this skew the market? Was it fair? This was when there were discussions with the FMC and the European Commission over whether there was still a fair market.

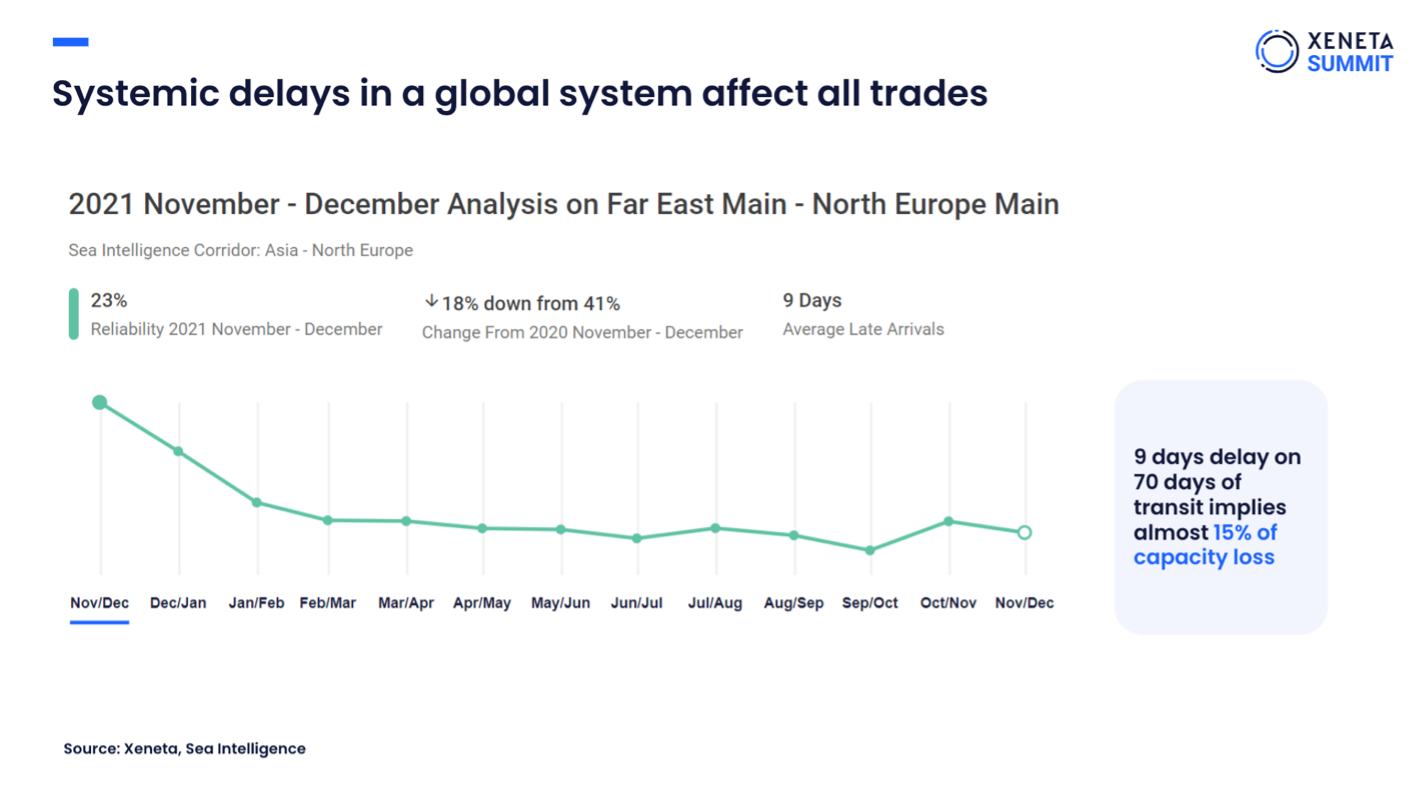

There was also a reduction in ports’ performance, with more waiting time, less punctuality and less available capacity. This particularly affected the US West Coast, where an unfolding traffic jam could be likened to a difficult game of Tetris.

Learning where you stand with your suppliers

The largest shippers in the world have learned something about their relationship with their suppliers. The smaller shippers have also had to adjust to how things have been. Maybe they did not have the relationship in the supply chain they previously thought.

So some shippers may have an element of payback in mind as we now enter a new phase. The recession has started to bite in some markets, and demand for goods is dropping. Shippers were willing, through gritted teeth, to weather the high leap in prices to meet point-of-sale contracts and to retain customers, but moves were in place to mitigate that exposure.

Manufacturing of some goods could be shifted to more local production, some goods were just not economical to shift at all, and some became cheaper to move by air freight.

The capacity wheel has turned, but will things return to pre-Covid levels? The worst does seem to be over, so time to start the discussions again.

We are not seeing the 40% to 50% premium anymore. However, we still see a differential of about 20% in some cases, so regarding the freight forwarder customers, we are not back to normal yet.

Maybe now is a good time to start the discussion with the freight forwarder to try to go back to the kind of regular levels of the past.

The schedule is evening up. The capacity that was parked on the ocean previously is now being applied again, which is, of course, putting pressure on the market, not only on Asia to the US, but also Asia to Europe. Ships can be turned around faster again, so capacity is being released.

As the Vice President of Xeneta’s Customer Solutions Team, Michael Braun, says: "Some shippers may still be in a position to pay higher rates, there will be differing relationships, but there is a reason why certain carriers are now being extremely aggressive on the spot market. They would not do that if they had ships full of their own stuff.

"I think the worst they have at the moment, and this refers a little bit to the discussion with the FMC, is they might have a half-full ship with boxes from another carrier running on a 5,000 dollar long-term rate, and they don’t get anything themselves. I think this is the biggest struggle they are having now.

"So, they don’t get their 10,000 dollar rate shipped anymore, but their competitors are using their ships for the 5,000 dollar rate. That’s the reason why they now want to burn the market with a 1,500 or 2,000 dollar rate."

It seems the wagon may be gearing up for another spin around the rollercoaster.

Want to learn more?

Watch the latest monthly State of the Market Webinar to stay on top of the latest market developments and learn how changing market conditions might affect your contract negotiations.

.png)