Data highlights

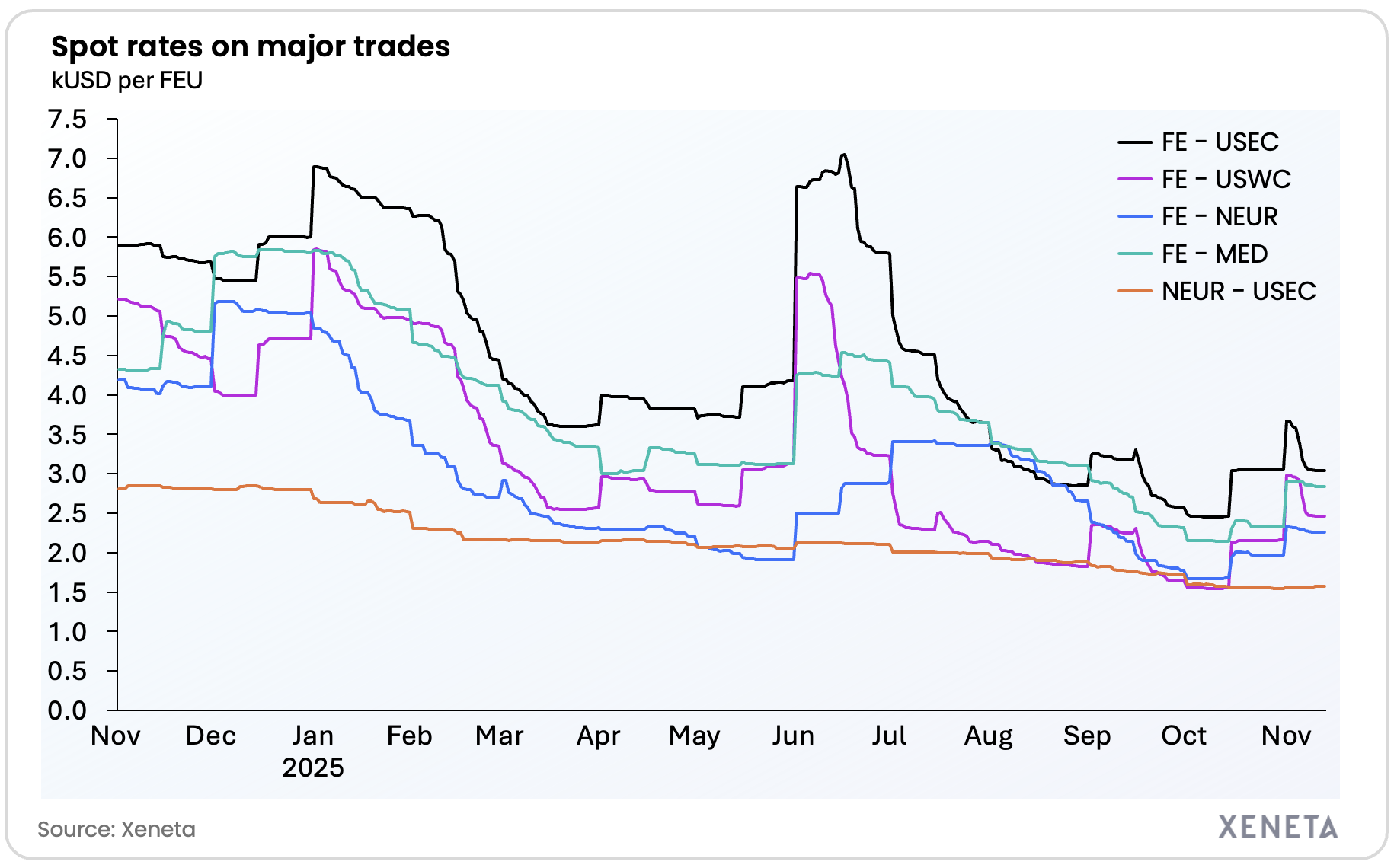

- Market average spot rates – 13 November 2025:

- Far East to US West Coast: USD 2459 per FEU (40ft container)

- Far East to US East Coast: USD 3042 per FEU

- Far East to North Europe: USD 2258 per FEU

- Far East to Mediterranean: USD 2840 per FEU

- North Europe to US East Coast: USD 1570 per FEU

- Offered capacity (4 week rolling average) – 10-16 November 2025:

- Far East to US West Coast: +9.2% from a week ago / +5.0% from one month ago

- Far East to US East Coast: +0.4% from a week ago / -2.1% from one month ago

- Far East to North Europe: +5.1% from a week ago / +0.3% from one month ago

- Far East to Mediterranean: +8.9% from a week ago / +8.0% from one month ago

- North Europe to US East Coast: +21.3% from a week ago / +16.2% from one month ago

- Following consistently declining capacity on the Far East to North Europe trade since September, offered capacity rose 5.1% from a week ago in the week commencing 10 November.

- Across the five main haul trade lanes, carriers offered more capacity this week, than they did a week ago. Ranging from +0.4% from Far East into the US East Coast to +9.2% into the US West Coast.

- On the North Europe to US East Coast trade, capacity that was supposed to be introduced last week got delayed – so the increase for this week will be 19.8% after a rise of 9.2% last week.

- Average spot rates on all main fronthauls out of the Far East decreased in the past week following the initial uptick in the beginning of November, with only the Transatlantic inching upwards.

- The highest week-on-week decrease in average spot rates is into the US. Rates are down 8.8% into the US West Coast and down 4.3% into the US East Coast.

- The spread in spot rates between the Far East to US West Coast and Far East to US East Coast has narrowed significantly, reaching a one-year-low at USD 473 per FEU on 5 November. Although the spread has risen to USD 583 since then, it remains significantly below the level observed a year ago. The decline in spread is mostly influenced by the more severe drop of rates into the East Coast than the West Coast.

- Spot rates to the US East Coast are back at similar levels to the end of October. The drop into the US West Coast was not as severe and is up 13.9% in comparison to the end of October. The higher exposure of the US West Coast trade to US-China geopolitical developments is behind this.

- From a week ago, average spot rates into Europe slightly decreased, down 1.8% to the Mediterranean and down 1.5% to North Europe.

- On the Transatlantic, rates are moving sideways, up 1.1% from last week.

Xeneta analyst insight

Peter Sand, Xeneta Chief Analyst:

“Market sentiment is a powerful force in container shipping and we see this right now in the spread in spot rates between the Far East trades into the US West Coast and US East Coast.

“The US West Coast trade is more sensitive to market sentiment than the US East Coast when it comes to US-China geopolitics. The sentiment effect of the 12-month lowering of US-China tariffs and suspension of port fees earlier in November means spot rates into the US West Coast are holding a little stronger.

“Taking a wider view, container shipping offered capacity is increasing on all fronthaul trades and this will have an impact on rates, with carriers likely having less success with GRIs (general rate increases) than they did in October and early November.

“Reports this week that Houthi militia have ceased attacks in the region is cause for optimism, but there are many steps to go through before a largescale return of container ships to the region becomes a reality. If it does happen however, the situation will become exponentially more challenging for carriers because it will flood the market with capacity and accelerate the downward trajectory for freight rates.”

Ends

Journalists can be added to the distribution list for Xeneta Weekly Market Updates by emailing press@xeneta.com.

Xeneta’s Media Contacts:

Philip Hennessey

Director of External Communications

Xeneta

+44 7830 021808

press@xeneta.com