We are constantly looking for data that can have true market impact; Xeneta is the only source that provides this for container freight. It provides detailed, global coverage of both long and short-term rates, allowing us to provide research that accurately predicts changes in earnings for shipping lines. Having looked at all data providers available, we are very happy to have finally found one accurate and broad enough to provide value to our clients.

The Challenge

DNB Markets’ Shipping Team publish regular equity research reports on major shipping lines, including Maersk. Reports contain buy or sell recommendations

based on their view of each line’s likely future earnings. DNB looks to create models of future earnings to support their recommendations, by using data sources available to them. Other data sources in the market could not accurately forecast shipping lines’ earnings as they were either inaccurate or only had limited coverage (both geographically and by type of contract). DNB needed to find a better data source to be able to include accurate forecasts in their reports.

Solution | Outcome

DNB subscribed to Xeneta, the world’s largest database of contracted ocean freight rates. Xeneta’s data covers all global trade lanes and includes both short and long-term rates. Xeneta’s data allows DNB to understand the global market and see changes in rates which will affect carriers earnings.

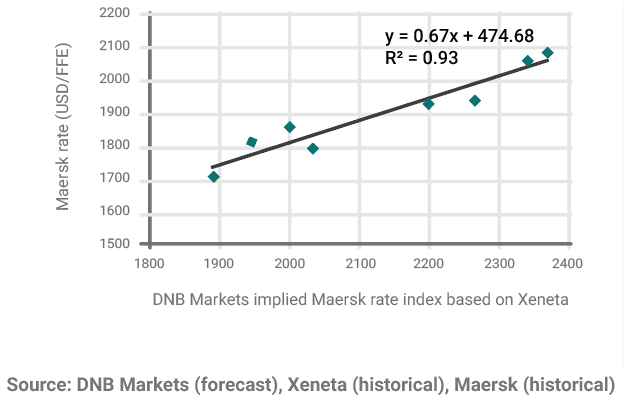

DNB built a model based on Xeneta’s data, which accurately (R2 = 0.93) predicted Maersk’s earnings historically. DNB can now use this model to forecast Maersk’s earnings before they are released to the public, allowing them to provide better guidance in their research reports.

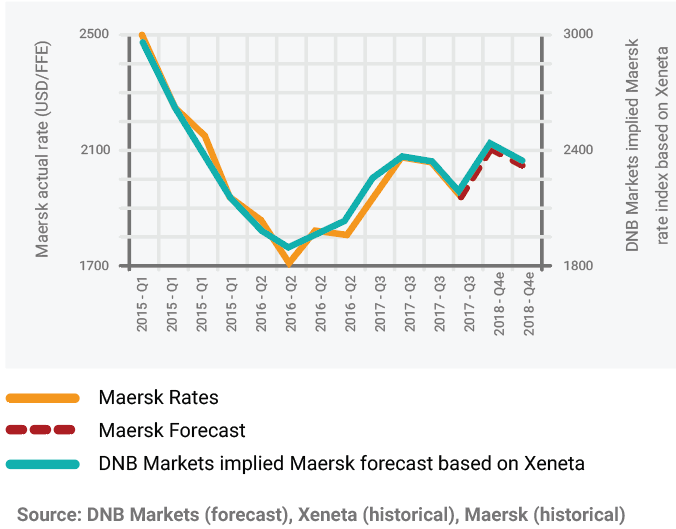

Xeneta’s data allows DNB to estimate Maersk’s average container rates across all their global corridors. Their model weights these averages by Maersk’s global volumes to produce an average container rate. Changes in this average can then predict changes in Maersk’s reported actual container rates, predicting changes in revenue, profit, and ultimately share price.

Our new Xeneta-based rate index versus Maersk's actual reported container rates including forecasts for Q1 and Q2

Our new Xeneta-based rate index model shows a tight correlation with Maersk's actual reported rates with an R2 of 0.93