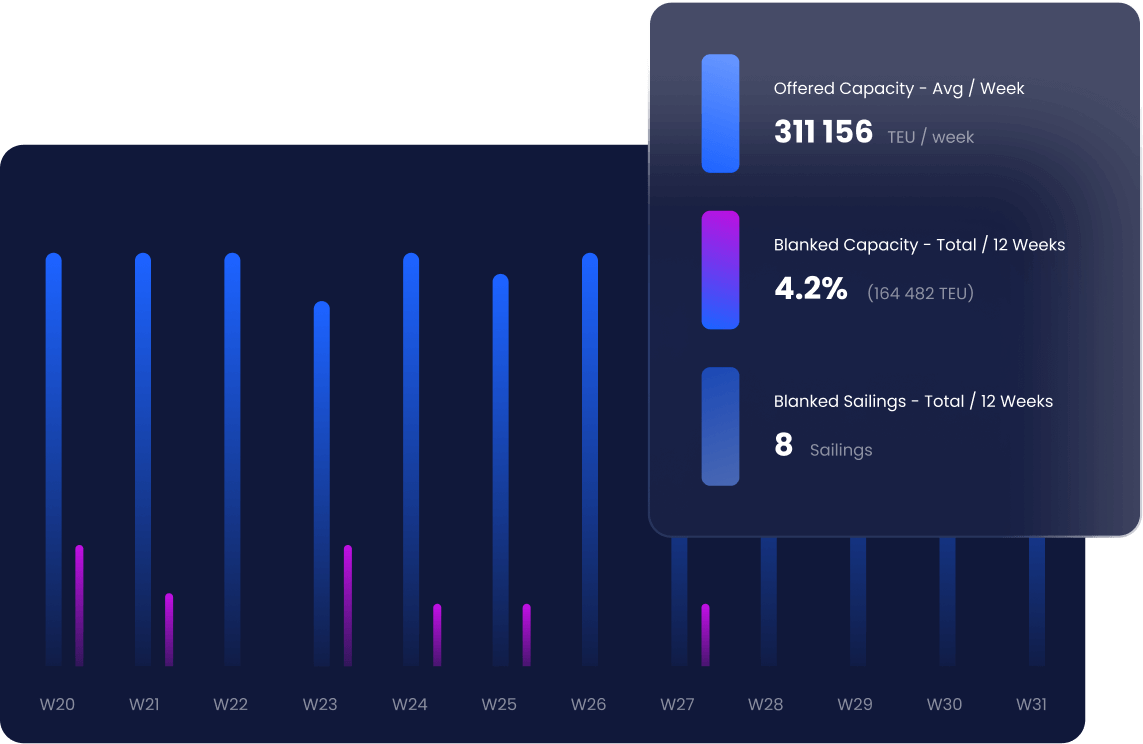

Shippers

Shippers using Xeneta see an average reduction in annual freight spend of 6.5%. Using the Xeneta platform to monitor the market, report and align internally, identify opportunities and risks, and inform your budgeting and tender decisions is key to a leaner, smarter, agile supply chain.

.png?width=387&name=Blog%20Banners%202022%20(4).png)