With the right partner, a shipper and carrier/freight forwarder can sweep aside the competition, allowing for incredible growth for both parties. However, the changing environment may have a profound impact on supplier relationships. What might have started as a good arrangement in the beginning, may not always withstand the test of time.

Shippers ditching and switching carriers is quite normal and the standard in the day-to-day shipping environment. This happens on all shipping trade routes in all countries across the globalized world. There are many reasons why shippers would switch carriers. Among them:

- Customer service satisfaction

- Efficiency of shipping service

- Rates

- Risk Management

- Loss of Trust

While the most obvious reason for a shipper to switch suppliers is the result of bad service, that’s not necessarily the only reason. The need for better service makes shippers constantly evaluate their business strategy, which by default, would have to include service suppliers as well. The question remains: What motivates a shipper to switch supplier? While the question itself is rather straightforward, the answer is not.

Related reading: How To Excel In Your Freight Rate Negotiation

What Is The Difference?

April 1, 2017 saw the launch of three alliances: 2M, Ocean Alliance and THE Alliance which controls container trading mainly on the Trans-Pacific and a major part of Asia-Europe.

These 3 alliances cover 11 lines (all 10 from the Top 10 container lines + 1

from outside the Top 10) and collectively account for about 71% of the global container market share leaving only 22% for the other lines.

So, if you take any of these alliances as an example, the carriers in that alliance will have the same routes, same port pairs, same transit time, same types of containers (some may not offer special equipment), same delays when there are delays, more or less the similar rates.

What sets one liner apart from the other? What is the #1 reason why a lot of shippers switch carriers?

Customer Service Satisfaction

Let’s say you are a shipper and you had a shipment with a carrier that gave you a lousy rate (lousy rate for an OTI (Freight Forwarder/NVOCC) means a high freight rate) AND gave you lousy customer service, which gave you an overall bad experience with that particular carrier.

Surely you had that kind of experience sometime in your shipping business. Do you remember the experience more because the carrier provided you a lousy service or because they gave you a lousy rate?

Chances are that you will remember that experience (maybe for years) mainly because of the lousy service than the lousy rate. Why? Because if it was only a question of rate, you had a choice to either accept the lousy rate or walk away from it. There was no pressure on you to accept it. You were exposed to the rate before you were exposed to the service.

But once you accept the rate and book your cargo with the carrier and then get lousy service, you can’t just walk away from it. That lousy service would affect you and possibly your relationship with your customer, which in turn can be the cause of you losing the business.

3 in 5 Americans (59%) would try a new brand or company for a better service experience.

Source: American Express Survey, 2011

The more competitive the market becomes, the more important the level of customer satisfaction. Never underestimate the importance of great customer service and its impact on the customer.

Efficiency Of Shipping Service

If you are a supplier of products involved in JIT (Just In Time) businesses such as automotive or retail, carrier transit times are crucial. If the carrier fails to deliver on time as promised, this could cause assembly line or production stoppages for the shipper which impacts heavily on their businesses.

There are several cases where after a carrier has been awarded and accepted a shipping contract, they "short-ship" meaning they choose to accept certain cargo on board and others not, even if the cargo has been booked and agreed.

This puts the shipper in a tight spot where the shipper now has to go out into the ad-hoc market and look for an alternate carrier to ship their cargo. This could also mean that the shipper will pay extra costs than what was agreed with the original carrier who got the contract.

The carrier may have a variety of reasons for short-shipping customer cargo. However, in most cases the #1 reason is because of the rate. In a strong market with little capacity, if a carrier can take on board cargo that was contracted at a higher rate than its neighbor box, which was contracted at a lower rate, the carrier will in most cases take the higher priced box to make a profit.

During the most recent negotiation season we asked one of our shipper customers to list five reasons that would cause a shipper to switch carriers. He responded fast and directly - with Pricing 5x. Then he added, “At the end of a bidding process, the decision is often based solely on price. Why? It’s the easiest way to measure a partner.”

Another customer noted the lack of willingness of incumbent carriers to reach consensus on what the appropriate rate level is. Suppliers distrust and question the new negotiation results and sustainability of prices offered by new suppliers. As a result, there is mutual disagreement and inevitably the negotiation falls apart that may prompt the shipper to switch supplier.

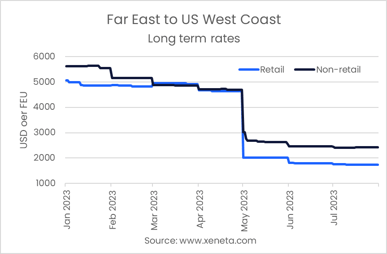

The best way to get unbiased data on ocean freight rates and know what is a competitive rate, is to benchmark against a neutral source that compares against the current market. This way the relationship is based on facts about the rates and not left to a gut feeling or any disagreement between shipper and supplier. The appropriate rate level would be what the current market rates are. This allows for a faster and more efficient negotiation cycle, which all parties would appreciate.

Risk Management

Businesses are evolving as customer requirements change. With such changes comes the need to manage risk. According to some shippers, a shift in trade lanes due to changing needs or a significant volume increase on another lane may result in the inability for the incumbent carrier to provide the requested capacity. Additionally, a customer’s requirements may change to the point that an incumbent carrier is not able to meet the new requirements.

Loss of Trust

Trust is critical to any relationship and a bad experience or contractual failure can destroy a shipper and supplier partnership quickly.

Since shippers rely on, and base their entire operation on the information that is provided by their suppliers, such as guaranteed capacity, transit time as well as any other variables, suppliers should strive to honor the commitments they made during the procurement process - one of our shipper partners noted.

Inevitably, inaccurate information and/or inability to stick to commitments could mean renegotiation and changing suppliers sooner than they may anticipated.

The Aftermath

In the end, there are a number of reasons as to why a shipper would look to switch suppliers. Everything from service, risk management, trust and of course, rates. Tools that provide insight into how shippers and suppliers perform against the market as well as determining if prices are truly competitive are needed increasingly as competition in a changing environment redefines shipper and supplier relationships.